A Few Investment Lessons. Part IV.

LIQUID INVESTMENTS AND THE MOTIF'S MARVEL

I have discovered CEFs (closed-end funds) and BDCs (business development corporations) by reading Seeking Alpha newsletter articles (free). Now, they are large part of my liquid portfolio.

My investments include the dividend-producing investment vehicles such as preferred stocks, ETFs, ETNs, CEFs, and BDCs. Each of them is using different strategies to generate the dividends, and, therefore, has a different level of volatility and dependencies on market conditions. Therefore, I must monitor the market and the Fed's moves because, for instance, the CEFs that utilize the leverage in order to generate mode dividends are very interest rate sensitive.

I have few CEFs in my portfolio that have high fees - something that scares many investors away. Do I care if the CEF management charges high fee? Yes, I do but not so much. Let's see, if the CEF has 8.6% dividend and charges 1.9% fee, the outcome is still 6.7% dividend. Not bad at all. In fact, the management fee is already being included into the balance, so, my dividend is still 8.6%. In my CEF evaluations, I look at several parameters beyond the fees. How about the leverage ratio? Is it too high comparing to peers? Can I find a similar CEF but with less or no leverage and exposure to the interest rate changes? What kind of bonds (if any) do they hold (B, BB, BBB rating)? When I am adding all those numbers in the spreadsheet in addition to all other valuations (including discount/premium), I can choose what to trade.

One approach that is discussed often is index investing. While I am not a big fun of it, I realize that most of the actively managed mutual funds under-perform the indexes, and it explains why some investors rely only on index ETFs. I have found one intriguing company that has a unique approach to investing by allowing the investors to build their own mutual fund with initial buying fee only $9.95 for all of the stocks included into portfolio. The company name is MOTIF Investing.

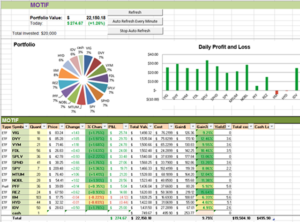

I have decided to give a shot and to build my own fund (the results shown below demonstrate the performance since February 2016).

My goal was to use the index (and some sector) ETFs that have matched or outperformed S&P 500 and/or Dow Jones for the last 5 years with the low fees (no more than 0.5-0.6%). The second goal is to generate at least 3.0% of dividends, so I have added PFF and IIM to help with it. I thought it would be better to invest $20K into this "fund" instead of keeping cash in the bank. I have invested $19.5K and left $500 cash untouched to cover any future transactions.

See the results below. The 9.79% profit for less than 6 months is not bad for cash that could be losing its value in the bank. If, at the end of the year, the performance of my own "mutual fund" will be still attractive I may add more money to it. Note: cash "gain" reflects the arrived dividends.

Considering the rest of my liquid investments, I also have allocated about 8% of them for momentum trading. I am trading AAPL, LMT, NOC, and few others that are not so dividend-rich but very good for swing trading.

I did not mention the bonds, yet. I have just few municipal bonds and diversified investments that include bonds but that is all. I like munis because they are more predictable and less vulnerable in addition to being tax-free.

HOW I TRACK MY INVESTMENTS AND MANAGE WATCH LIST

The investment research process has been greatly enhanced with new tools aim to support amateur, seasoned, and professional investors alike. Personalized and easily accessible investment research based on mobile platform, at a lower price (or free), is becoming the new standard.

Careful tracking of investment returns and "buy" list is a critical skill successful investors have. It's not enough to just glance at daily changes in stock prices. Experienced investors know they must evaluate and monitor their portfolios over a long period and analyze/scrutinize every past transaction.

Although online portfolio trackers are constantly adding new features and functionality, they still pale in comparison to software-based portfolio trackers. The majority of online portfolio trackers can only handle cash, stocks, mutual funds and ETFs; they are limited in their customization; and they offer fewer portfolio analysis features. Reports offered are generally less robust than those found in software programs.

However, the main upside for online portfolio trackers is that they are typically less expensive and, for the most part, easier to learn and use. In addition, online services provide the added convenience of being able to monitor your portfolio using smartphones and tablets. There is no software package to install and update, and users do not usually need to worry about OS platform compatibility.

I won't discuss the fee-based investment software that can be found online but rather some free or inexpensive resources that I have used personally and can recommend.

On the desktop, I use Finviz.com web site that, beyond having an excellent stock screener, has one time-saving feature that I love: when you move the mouse over the stock ticker, the window with the stock chart will immediately popup, in addition to a plethora of other fundamentals for each stock that is right there - no calculation is needed. I also use the modified spreadsheet (read below) with several fundamentals, live quote updates, and color indicators.

The Investment Tracking Excel spreadsheet, in particular, allows me to see the stock changes during a day (on-demand or auto-refresh), reflects the difference between year high and today's price, has the target price and deviation from it, and calculates total investments. I have also added the Stop Order price entry and the deviation from it. I only need to fill out few cells, and the spreadsheet does the rest. Very useful and more informative than original Yahoo Portfolio.

The Watch List Excel spreadsheet includes many fundamentals (like Yield, EBITDA, P/E, etc.) and starts with the Indexes on the top of the page. It reflects my "virtual" cost when I began tracking certain stock; it reflects current volume, year high and delta (deviation), as well as my target price and the delta. I have recently added the average volume and the pop-up indicators that would reflect higher volume than average.

Both spreadsheets are based on Excel Scout spreadsheet for investments that is offered free (by certified Microsoft Excel Expert). The spreadsheet is designed around Yahoo Finance data and includes Excel macros to refresh the quotes manually or automatically. I have modified it heavily by creating the Watch List and Portfolio Tracking and by adding more parameters and color indicators. It is nice-looking and editable (except macros) to your taste: for instance, you may want to add day high and low. You are welcome to use it too, just e-mail me and I will attach the file and explain the settings. If you are generous enough to reward my hours of modifications and tweaking, I would appreciate your donation.

INVESTMENT TRACKING

![]() Google. You may use the spreadsheet hosted on Google Drive for tracking of your investments and is pushing his readers to buy it for a sizable fee. There is nothing too complicated, and you may spend time and modify the similar spreadsheet to your likes without spending a dime, especially this one that is FREE download. With your small donation, I will share the comprehensive Google spreadsheet that can be re-used with your stocks. I have added several valuable calculations that help me making a trading decision in many instances.

Google. You may use the spreadsheet hosted on Google Drive for tracking of your investments and is pushing his readers to buy it for a sizable fee. There is nothing too complicated, and you may spend time and modify the similar spreadsheet to your likes without spending a dime, especially this one that is FREE download. With your small donation, I will share the comprehensive Google spreadsheet that can be re-used with your stocks. I have added several valuable calculations that help me making a trading decision in many instances.

![]() Google Finance Portfolio has a simple interface, and is easy to use and update. You must have the Google account.

Google Finance Portfolio has a simple interface, and is easy to use and update. You must have the Google account.

![]() Investing.com. This web site offers a ton of data, portfolio tracking, and excellent charts for free. You may add several stocks into one chart for comparison.

Investing.com. This web site offers a ton of data, portfolio tracking, and excellent charts for free. You may add several stocks into one chart for comparison.

![]() PersonalCapital.com site is for those who are close or entered into retirement years. You can add all your investments from different sources including credit cards, and the site will track your investments with very informative reports about cash flow, not to mention analysis of your chances for safe retirement.

PersonalCapital.com site is for those who are close or entered into retirement years. You can add all your investments from different sources including credit cards, and the site will track your investments with very informative reports about cash flow, not to mention analysis of your chances for safe retirement.

![]() Mobile Tracking. These days, everyone has a smartphone. Use it to your advantage and track/manage your portfolio while you have no access to the desktop. First of all, you can upload your spreadsheet to the smartphone or tablet and use it the same way as on the desktop but I doubt you find it always usable enough. Rather, use available applications from Google Play (if you have Android phone) or iTunes from Apple.

Mobile Tracking. These days, everyone has a smartphone. Use it to your advantage and track/manage your portfolio while you have no access to the desktop. First of all, you can upload your spreadsheet to the smartphone or tablet and use it the same way as on the desktop but I doubt you find it always usable enough. Rather, use available applications from Google Play (if you have Android phone) or iTunes from Apple.

I have tried multiple apps on my 5.5" Android phone but stopped at the following:

StockSpy, Teletrader Stock Markets, Investing (from Investing.com), My Stocks Portfolio, and Stock Value Analyzer S20 in addition to apps from online brokers: TDAmeritrade Trader, e*Trade, and Fidelity. They cover my needs very well.

![]() Portfolio Tracker. - import all your actual accounts' investments in one place (401K, brokerages, etc.). One of the best trackers per some opinions.

Portfolio Tracker. - import all your actual accounts' investments in one place (401K, brokerages, etc.). One of the best trackers per some opinions.

![]() Morningstar Screener.

Morningstar Screener.

![]() Morningstar Instant X-Ray.

Morningstar Instant X-Ray.

Enter all your investments and check the total allocations. This is extremely useful tool to analyze your assets allocation from different investments. As you know, some ETFs/CEFs have the assets from different industries with allocations that vary.

This tool will allow you to see the concentration in particular industries or country, or in asset type. When I used it first time, I was quite surprised and had to adjust my portfolio. If you want using it on the level that is more comprehensive with in-depth analysis, there is a premium option.

Free Excel Spreadsheet for a comprehensive Single Stock Analysis.

And finally, something worth reading: http://www.safalniveshak.com/10-simple-rules-that-brought-me-financial-nirvana/

and http://www.safalniveshak.com/10-investing-gems-from-peter-lynch-one-up-on-wall-street/

with http://www.safalniveshak.com/do-not-invest-in-index-funds/

http://www.safalniveshak.com/manifesto-of-small-investor/

Key Takeaways

- Buying investments requires evaluation of fundamentals, charts, and comparison with its peers. Use spreadsheets as a valuable tool.

- The dividends can be the game-changers.

- You have the chance to become your own fund's manager with MOTIF Investing. Consider it for your portfolio.

- Free resources can safe you few dollars. Do not hurry up spending them for costly investment software.

- My approach to investing may not be suitable to you but if you find anything useful in my investment strategies use them and improve.

- The world has changed. Change your diversification strategy. Investing only in stocks and bonds is very risky.

- Sound diversification is different for everyone and depends on financial situation, age, and investment experience. No strategy will perfectly align with any one investor's values or unique circumstances.

- Not everything is gold even if it is shining… Be cautious.

- Tangible assets are less susceptible to market crashes especially if they are income producing.

- My approach to investing may not be suitable to you but if you find anything useful in my investment strategies use them and improve.

Author's Note: Please excuse any typos. I assure you that I will do my best to correct any errors if they were overlooked. I have several long positions in the stocks shown on the snapshots (except the watch list) but in no way suggest them for your portfolio. Do your own due diligence. I have no associations with mentioned web sites or businesses and I do not intend promoting them. I also do not sell investment software but rather share "for free" with fellow investors if I did not pay for any piece of it.

Disclaimer: This article is intended to provide information to interested parties. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before following any investment strategies or rules mentioned or recommended.

(

(

Comment from Gary Hojell:

I would include as a cardinal rule: Preserve your capital base at all costs. Never use margin, avoid going short (hidden cost of shorting: interest payments to your broker for the duration of your short, you are required to PAY the dividends to the originator of the stock you borrowed to short, potential large losses if the stock moves opposite your position.

Agree, my rule of thumb is never invest in anything that may lose value after you are retired. Also, you don’t live long enough to recoup the inevitable losses.

Comment from Sally Sue:

Thank you for a wonderful article that I know will help me through the jungle of stocks. Where would I look for the top 10% Best companies, Sectors?

Thank you, Sally Sue.

Sally, I use the IBD (Investors Business Daily) at http://www.investors.com. I do subscribe to their newspaper (getting one per week on Friday eve) and I have access online.

For high interest bearing stocks (mREITs, BDC, …), have you considered using option collars as an insurance policy for the downside? For instance, assume you buy shares of high dividend stock, and you are able to capture a few percent initial capital gaines. You could sell covered calls (now that their value has increased in tandem with the stock price) and buy puts with the proceeds. The paired options should have identical expiration dates. If the shares move upward to hit the call strike price, you have collected high dividend interest with minimal risk while limiting further cap gain.

If they move downward to hit the put strike price, you, again captured the dividend interest and offset capital loss by exercising now more valuable puts. you adjust the strike purchase of each purchase so that the net cost of the option pair is near ZERO.

Hi, unknown,

I have to admit that I have no adequate experience with options, and, therefore, I did not suggest any strategies in this article. You advice could be very valuable to those who use options trading. I am myself planning to learn more about options and use them in my strategies in order to protect the principal.

Option trading usually is more complicated, and requires intensive studies as there are various strategies available. Your strategy sounds very interesting as well as quite complicated. I am going to review it in my future studies.

Best in investing!

This may be a good advice for people with understanding of a stock market. That leaves 90% of population, so you are better off buying guaranteed CDs for 2.5% for four years and watching your saving grow 10% every four years. Regardless, though, you want to put minimum of 10% of your wages away every pay period your entire career, or you won’t have enough.