My unbiased and comprehensive take on retirement planning. Part III.

This is a final Part III of the post. If you have missed previous parts, find them here: Part I and Part II.

This is a final Part III of the post. If you have missed previous parts, find them here: Part I and Part II.

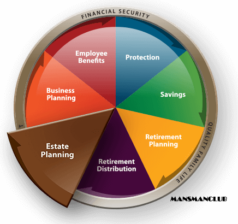

HAVE A FINANCIAL AND ESTATE PLAN

As a part of your retirement plan, think about your family members who depend on you financially—and who may outlive you. Income annuities, investment income streams, and life insurance might all be part of that plan. I have asked my lawyer to prepare three main documents for my estate planning (the Living Will, the Last Will, and Testament, the Power of Attorney for Health Care).

Keep in mind that your taxes may not be lower during retirement. All the signs point to higher taxes in the future for everyone (think about Democrats in power due to the shift in the U.S. population toward minorities).

ASSIGN THE PRIORITIES

Put retirement savings ahead of other goals, like college or a vacation home – there won’t be other chances.

HEALTHCARE

Place health care high on your list of fixed expenses. The Motley Fool says the average couple will need $400,000 for retirement health care expenses—if they’re healthy. Pretty scary, isn’t it? Medicare plus supplemental insurance can cost a retired couple more than $700 a month -- a big monthly hit, and they’ll grow each year. So far, I am using Kaiser Permanente as my supplemental insurance – not the best one but with a low fee. Prescription drugs can also be a large expense if you have some unpleasant health conditions. Remember that Medicare has no out-of-pocket limits.

On top of those out-of-pocket expenses, you’ll also need to pay various insurance premiums. These expenses will vary based on one’s income in retirement (Medicare premiums are income-based), the type of coverage selected (Medicare or Medicare Advantage, plus any Medigap plan and Part D prescription drug benefit), individual health care needs, and, to some extent, location.

Yes, the Medicare Part B fee is also deviates based on the place you are planning to live. I have found, for instance, that the cost of Medicare policies in Florida is higher than in my State.

LONG-TERM CARE

The last concern is long-term care (LTC). If you don’t have LTC insurance, you are on your own—unless you deplete almost all your assets, at which point Medicaid kicks in.

How much risk is there?

Following statistics, “about 70% of seniors will need some type of long-term care including both in-patient and at-home care—and both paid care and care provided by family and friends. An estimated 42% of seniors will require paid in-home care, 35% will need nursing home care and 13% will require care in an assisted living facility, with care typically lasting one year or less”.

Careful long-term care planning will let you:

- Identify the financial resources available to pay for care

- Protect your retirement, estate, and legacy plan

- Allowing you to maintain independence and control

- Address where the care will be provided and who will provide it

- Allowing your loved ones to supervise care rather than provide care

I am planning to add more to this topic in a separate article because long-term care is a complicated matter.

Folks, there is a significant financial risk. Plan accordingly.

PLANNING FOR LEGACY

That is money you want to leave to heirs or charitable organizations. Since the desired legacies are very personal, it is up to you to plan to leave specific amounts or just leftover (which could be nothing). It could be some tangible assets such as valuables, art, real estate, or it could be proceeds from annuities and/or life insurance.

Tip: If some of your savings are designated as a legacy, consider investing that portion in a more aggressive portfolio so it can keep growing.

HOW TO AVOID MISTAKES IN RETIREMENT PLANNING

HOW TO AVOID MISTAKES IN RETIREMENT PLANNING

The best way to avoid mistakes is to know about them in advance. Let me count just a few:

- Failing to learn and quickly correct the mistakes

- Wrongly estimating the age of retirement and corresponding Social Security benefits.

- Underestimating the tax rate during retirement years

- Underestimating the risk of inflation

- Overestimating your ability to continue working during retirement years. Even if you are relatively healthy, your parents might be not, and you may need to take care of them as it happened in my family.

- Underestimating your needs. The average person will need to replace 80% to 90% of their pre-retirement income in retirement.

- Wrongly estimating healthcare cost. Per the Bureau of Labor Statistics, the average healthcare expense for 65 years old and above is $500/month that is a big chunk from your Social Security check alone. 75% of senior citizens said that health problems arose earlier than they have anticipated.

- Becoming too conservative with your investments. Your plan with extra safety may not be so safe because of the risk of inflation, especially for those with pensions without inflation adjustments. While the return on bonds can be battered by inflation, stocks provide better long-term protection against the risk of unexpected inflation.

- Failing to provide for a spouse. Couples should take into account that upon the first death, Social Security benefits will be reduced. While living expenses may be reduced, the reduction in income should also be considered.

- Failing to develop multiple streams of income and living below your means.

- Failing to create an emergency fund (to cover 6 months of your living expenses)

- Underestimating the importance and need for diversification.

- Failing to re-balance portfolio periodically. You should do it at least once (or better twice) a year. If your asset allocations have slipped away from your targets, restore allocations through balancing: sell some parts of strong performers and buy weaker performers.

- Planning to take retirement withdrawals from the wrong locations, and, therefore, overpay on taxes. The rule-of-thumb approach for the most efficient order of withdrawals from retirement savings is to first draw down the taxable accounts, then the tax-deferred accounts —such as a traditional individual retirement account and 401(k) — and finally the nontaxable accounts (Roth IRAs). Talk to your tax professional about this as your situation may be different.

- Failing to recognize that retirement will affect your psychology and identities as a spouse or parent. The most important thing to remember: have the purpose in retirement and the plan for what you are going to do with your extra 8-9 hours a day of free time. Otherwise, you will hate every minute of your retirement as many men who have failed to plan hate it.

As I have promised at the beginning of the article, here are some resources for calculating your expenses during retirement years.

- https://maxifiplanner.com (I use it personally for my retirement planning). Advertised as “the only software powerful and accurate enough to calculate your highest sustainable living standard — starting today — with a plan to maintain and raise that amount — for life.”

- https://www.m1finance.com/ Advertised as: “M1’s sleek, intuitive interface makes managing your investments easier than ever. Plus, we don't charge commissions or management fees, so your money can go even further for your future making it easier for investors to build their portfolio and maximize returns”

- https://www.personalcapital.com (I use it to track all my investments in one place. Very convenient! Personalized service is offered). Advertised as: “Transform Your Financial Life. Get guided expertise in establishing a plan that adapts to your wants and needs with our trusted advisers. Personalized portfolio management”

- https://www.ssa.gov/begin-est/

The last link is a Social Security Benefits Estimator. The Retirement Estimator gives estimates based on your actual Social Security earnings record. Please keep in mind that these are just estimates.

You can use the Retirement Estimator if:

- You have enough Social Security credits at this time to qualify for benefits and

- You are not:

- Currently receiving benefits on your own Social Security record;

- Waiting for a decision about your application for benefits or Medicare;

- Age 62 or older and receiving benefits on another Social Security record;

And this is what the SSA wants you to know:

Your estimated benefits are based on current law. The law governing benefit amounts may change because, by 2034, the combined trust fund reserves are projected to become depleted – the same as projected last year. Payroll taxes collected will be enough to pay only about 79 cents for each dollar of scheduled benefits.

In short, invest in a way that will provide a steady income stream in retirement. Plan your investments accordingly, so, you are not totally exposed to stock market fluctuations. You don’t want to worry about where that planned 4%-5% or 6% withdrawal rate will come from each year.

Please share your thoughts!

Like the article? Become a club member for free and get notified about the new posts. 100% spam-free!

DISCLAIMER:

I am not a financial professional, and, therefore, I have expressed my view on the subject based on my own experience and research. Investors are expected to do their due diligence and/or consult with a professional who knows their objectives and constraints. I have used some resources on the Internet, and truly appreciate all authors whose thoughts were included in the article. My apologies if I have mistyped any word (although, I have used the spell checker) or my writing style is not up to your taste (I am not a professional writer, either).

Today is November 2022. After the time went since I have published this article, I have realized that I did not cover the RMD (Required Monthly Distributions). I promise to publish a new article (aka Part IV) very soon.