A Few Investment Lessons. Part I.

The traditional diversification is dead. A few investment lessons were learned by the regular guy. Part I.

Summary

Summary

- You all were beginners at some point.

- I have been lucky to be a mentor for many IT professionals and therefore I have the mentor’s attitude but I don’t pretend to be the one for investing. I just want to share my view and strategies on investing and free investing resources.

- Globalization and advanced trading technologies have changed the stock market dramatically.

- The political environment is radically different than it was years ago, and it is something that must be taken into account.

- The volatility became higher and it requires more monitoring of your assets.

- Diversify differently in order to achieve your own goal.

This article has several parts where I discuss some issues that I consider important for today’s investors.

Let me tell you upfront: I have never been an investment professional. This article is my chance to share with you what I have learned after 20 years of investing and, more importantly, to get your feedback on my investment ideas and style.

I certainly realize that they are not close to the score “very good” (I am not even talking about “perfect”) but I believe that since 1996 when I began my journey in the investing world, the market and active investing taught me a few important lessons.

As a novice, I started investing with several mutual funds using one of the online brokers, and then slowly added some stocks that I have found through several newsletters from “gurus” of investing.

Looking at my trades now, it is obvious that I have made all the possible mistakes the beginners usually make: buying high and panicky selling low, choosing the wrong stocks (including penny stocks) and ignoring the market trend, not learning the charts, not having the investment plan, no strategy… oh, well, you know what I am talking about.

Even 12 years later, in 2008 when I had, perhaps, some investing experience, I have violated my own buy/sell rules and have lost about $80,000 during the market crash by failing to sell when it was defined by my selling rule in the hope that it “cannot go lower”.

The big problem for any investor is being lazy to go back to your past trades and analyze your own mistakes or success. Have you lost money on bad trades? Why did it happen? Wrong stock? Bad timing? Have you watched the market at the time of purchasing the stock? All these and many more questions must be answered or you will “step on the same rake” again, and again.

I confess that I was lazy for many years. Serious investing requires a serious approach and hardworking. Non-stop learning, adjusting and polishing your investment style, having the right tool for monitoring/research, and, finally having the inexpensive online broker with add-on values – all of it is the components of future success. Otherwise, don’t do this on your own.

At some point, a few years ago, I began analyzing all my past trades, and it helped me avoid old mistakes. I finally saw more profits than losses.

DIVERSIFICATION? BEEN THERE, DONE THAT.

DIVERSIFICATION? BEEN THERE, DONE THAT.

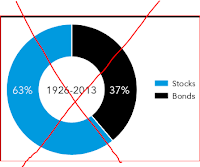

Yes, you heard it over and over: 60% stocks, 30% bonds, 10% gold… oh, no…, 50% bonds, 20 % US stocks, 20% International stocks, 5% gold, 5% treasury. Does it sound familiar? The problem is that it is NOT working for everyone as suggested by talking heads from multiple sources.

When some investment guru suggests traditional diversification, it is usually based on previous performance and market conditions for the past 20-25 years. The right diversification should be different for different investors, not to mention that previous 20-30 years were different: different governments, different global situations, different technology involved in the trading, different investments beyond traditional stocks and bonds, and many other factors that point to one simple statement: regularly suggested diversification that worked previously is not working as expected today.

Let me ask you, did we know China as one of the persuasive powers in the investment environment 20 years ago with its influx of millions of investors? Did we have the High-Frequency Trading (HFT) investors that cause more volatility daily? Or something fancy like "algo" (algorithm) trading? Did we have the European Union on paper legs? Do you know how many new traders are there on the market from developing countries? Was the Fed so influential 20 years ago? How about the trillions of debts?

You see, the market has changed dramatically following the global changes inside of our country and the growing influence of developing countries including China, Brazil, Russia, India, and a few others. The Fed’s manipulations with QE and interest rates along with globalization have vividly changed the global and U.S. market. I don’t have to prove it – you may read about it daily.

Here is a beginning of the June 15th, 2018 article in Time.com:

…You know something is deeply wrong in our market system when a company like Microsoft, which has $100 billion in cash sitting in bank accounts (much of it offshore), decides it needs to borrow billions to fund its acquisition of the social networking platform LinkedIn.

The deal highlights one crucial way in which our market system is no longer serving the real economy. Why would a cash-rich firm like Microsoft go into debt and cause rating agency Moody’s to put it on a possible downgrade list? Because it will save around $9 billion in U.S. taxes by doing so. Debt is tax-deductible, and borrowing will save Microsoft money relative to bringing overseas cash back home and paying the U.S. corporate tax rate on it…

…Microsoft certainly isn’t alone in taking advantage of this phenomenon. U.S. companies have issued a record amount of debt in recent years, even as they also have record cash hoards. Take Apple, one of the most successful firms over the past 50 years. Apple has around $200 billion sitting in the bank, yet it has borrowed billions of dollars cheaply over the past several years to pay back investors via stock buybacks and dividends in order to bolster its share price (because the underlying corporate growth story hasn’t done that on its own)."

Let me throw the wrench… Another thought that came through my mind was that full diversification across the industries and sectors is the wrong approach. If you equally invest in each sector, the sectors that perform well will generate gains but the sectors that are on the bottom will cause you heavy losses (like materials for the last few years).

The result? Your yearly total is close to zero in the best-case scenario. Even if you wait for long enough, your best-performing sectors will become the worst (you know about the “market rotation”, right?), and the result of your investment will be the same. You may disagree with me but it is what has influenced my investing approach, too.

This is a reason why I look at the best 10% of industries/sectors/groups that outperform the rest 90% every few months and I’d rather invest in those groups than fully diversify.

Unless you want to ignore all those factors and do not care about the potential risk of losing part of your investment, traditional diversification doesn’t work. Period. Just look at the bonds today and their prospects for the next several years with rising interest rates…

We need another diversification strategy that reflects the oscillating market, has some degree of protection against global disasters inside or outside of our country and reflects the environment we live in and invest today with some potential implications. It is an almost impossible task to build one.

So, who the regular investor should listen to in order to build the right, diversified portfolio? Newsletter “gurus” or Jim Cramer? Financial advisers? Retirement Services? My answer: listen to your own guts! Rely on your own understanding of the market (whatever it would be: pessimistic or optimistic) and your personal situation (age, finances, and investment experience).

Spend enough time to understand the stock market – it will pay you back handsomely. On another hand, if you want to look at your investments twice per year, get the “Go Fishing” portfolio suggested by Alexander Green (Oxford Club). I respect its concept but cannot fully accept the lazy, index-investing approach, not to mention the low profits. (I have some interesting investment approaches to index investing that I will discuss later).

If you think that I can suggest the best investment strategy, sorry, I have to disappoint you. What you can do is to get familiar with mine and make your own corrections or deny it completely. I bet you have different situations, finances, and expertise, and, therefore, you might have your own diversification strategy, just don’t stick to that 40%/60% mambo-jumbo.

To me, the diversification means separation of various assets into their own environment including those that are not so dependent on market conditions. Call me contrarian, fool, or whomever you want but I am completely ignoring suggested diversification from investment giants (Fidelity, etc.) and other investment professionals. Do they care about my personal investments? No. They write the articles to make money. I invest my own money to rely on it later and to make living.

For instance, I don’t feel secure investing abroad 20-30% of my assets. My observations over the years taught me that the foreign market is way more volatile than the US market. As one blogger noted: “When the US just “passed the gas” the foreign markets experience earthquake”. The foreign market volatility is beyond my comfort zone, especially when I am closer to retirement.

The globalization and existence of thousands of ETFs that diversify their investments across several countries blur the borders between US and foreign investments. I don’t usually have pure foreign stocks but I still have a few investments that have foreign market exposure with the amount of money invested in it being well below even 10% of my assets.

If you don’t have a good strategy and the set of trading rules that you have to follow religiously you will experience either losses or just an average return (http://seekingalpha.com/article/3975500-average-investors-get-average-results-retirement ).

Please continue to Part II under Category: Investments