Investor Education: MORTGAGE REITs

WHAT YOU NEED TO KNOW ABOUT mREITs

WHAT YOU NEED TO KNOW ABOUT mREITs

Now, let’s talk about mREITs. The “m” stands for “mortgage,” as mREITs are a special group of REITs that base their real estate investments in the mortgage market. In most cases, this means that mREITs buy mortgages on the secondary mortgage market – they purchase mortgage debts while REITs purchase physical properties.

I want you to become familiar with a few abbreviations in the mREIT world.

- mREITs provide financing for income-producing real estate by purchasing or originating mortgages and mortgage-backed securities (MBS) and earning income from the interest on these investments. So, let me be clear: mREITs don’t invest in real estate properties per se and don’t lease the space. They rather provide important liquidity for the real estate market.

- mREITs invest in residential and commercial mortgages, residential mortgage-backed securities (RMBS), and commercial mortgage-backed securities (CMBS). mREITs typically focus on either the residential or commercial mortgage markets, although some could be the hybrid of both.

- mREITs hold mortgages and MBS on their balance sheets and fund these investments with equity and debt capital.

- mREITs rely on a variety of funding sources, including common and preferred equity, repurchase agreements, structured financing, convertible and long-term debt, and other credit facilities.

- Residential mREITs are typically grouped into two sub-categories based on their underlying investment portfolio.

- Agency mREITs invest primarily in agency mortgage-backed securities, or RMBS, which have their principal guaranteed by a Government Sponsored Entity, or GSE (Fannie Mae, Freddie Mac, or Ginnie Mae) and carries minimal credit risk but tend to be more highly sensitive to interest rates.

- Non-agency mREITs invest in RMBS and other types of residential mortgage credit that are not guaranteed by a federal agency including mortgage servicing rights (MSRs) and whole mortgage loans, which have higher levels of credit risk but tend to be less sensitive to interest rates.

- Similar to equity REITs, commercial mREITs tend to focus on one or several property sectors with relatively lower levels of leverage compared to residential mREITs. Commercial mREITs can also be further segmented into two categories:

- pure balance sheet lenders - which originate and purchase loans for their own balance sheet

- balance sheet/conduit lenders which originate and purchase loans both to hold on their own balance sheet and also for the purposes of securitizing the loans into a CMBS or other vehicle.

mREITs’ general objective is to earn a profit from their net interest margin, or the spread between interest income on their mortgage assets and their funding costs.

When an mREIT is established, it usually specializes in one type of mortgage debt. Some companies only buy mortgages that are backed by a federal agency like Fannie Mae, Freddie Mac, or Ginnie Mae. Some mREITs choose these mortgages because they are backed by a federal guarantee offering a lower risk of default, however, they are also less profitable.

Other mREITs, sometimes called non-agency mREITs, specialize in mortgages that are not guaranteed by a federal agency. These tend to pay higher dividends, largely because there is a higher risk of the mortgages being defaulted upon. So, when you evaluate the mREIT, keep it in mind.

(click to zoom)

Similar to REITs, most mREITs are registered with the SEC and are required to publish regular financial statements for review and monitoring by investors and analysts. The business risks that mREITs face is similar to those of other financial firms.

Unlike other REITs which tend to benefit from lower interest rates, mortgage REITs are prone to prepayment risks resulting from an increase in mortgage refinancing during periods of declining interest rates.

To put it simpler: if you are making money on the interest of the mortgage and your customer refinances to a lower interest rate, you are losing some part of your profit.

Basically, mortgage REITs are susceptible to interest rate volatility which would not only face the high rate of refinancing but also cause uncertainties in their cost of capital.

mREITs typically manage and mitigate risk associated with their short-term borrowings through various strategies, including interest rate swaps, swaptions, interest rate collars, caps or floors, and other financial futures contracts. All those terms could be learned at your convenience, but for the beginners, I would skip them now.

When you evaluate the mREIT company, the encouraging sign is the rise in book value per share, which is critical to a mortgage REIT's ability to generate higher profits and deliver dividend growth.

One important note: pay attention to one major factor that impacts mREITs’ profitability and dividend yield: the changes in the bond market. mREITs do not only buy mortgages with reinvested profits from the company’s activities. In fact, since 90% of the company’s profits go to investors, the company needs to borrow money in order to purchase mortgages.

This is where the bond market becomes crucial to an mREIT’s operations. Since mortgage rates are tied to bond rates, an investor in mREITs needs to look at the bond market as well as the real estate and mortgage markets to understand that profit potential.

And now, please try to understand the following core strategy by mREITs:

They borrow money at short-term bond interest rates and lend it at rates near the higher long-term bond rates – when they buy mortgages, they’re essentially lending that money at current mortgage rates. Since mortgage rates are tied to the higher, long-term bond rates, mREIT profits are directly proportional to the gap (or “spread”) between short-term and long-term bond rates.

The larger the gap, between short-term and long-term bond rates, the more profitable the mREIT business becomes. If the U.S. Federal Reserve keeps its promise to keep interest rates low, bond spreads should remain big, and mREIT dividends should remain high.

Also, one of the most important steps in evaluating mortgage REITs is finding the price to book value ratios. Using that ratio gives you an idea of the regular range where the mortgage REIT should trade. Usually, all mREITs holding similar assets will be correlated with each other.

When you're estimating what happens with mREITs, you should always be able to break down your forecast between the book value and the price-to-book ratio. If you can't break that down, you don't have enough information to have an informed opinion.

It is not suggested to hold mREITs for the buy-and-hold portfolio due to the risk from swings in interest rates. However, you can buy mortgage REITs when they trade at huge discounts to book value like it is now with a bear market.

- Apparently, the biggest threat (risk) to mREITs is an increase in the short-term Treasury yield.

- Cutting the dividends due to various problems with mortgages including operating losses.

- Individual mREITs can also be hurt by poor-performing loans due to refinancing, non-payments, and even defaults on mortgage loans.

- Another drawback is when the mortgage loan is paid off earlier than anticipated, and mREIT would lose the potential profit.

- Limited capital is one of the risks to consider. Since REITs need to return 90% of their income to shareholders, with only 10% left in profits, they are seriously limited in how they can manage and reinvest their profits, which makes it hard to grow in good times and stay afloat in bad times.

- Most mortgage securities purchased by residential mREITs are agency securities backed by the federal government, which present limited credit risk. Commercial mREITs may be exposed to credit risk through their private-label RMBS and CMBS.

- Hedging risk. mREITs often use hedging instruments in order to control various changes in interest rates, credit risks, and macro situations. The value and accuracy of these bets can have a substantial effect on bottom-line profits.

As you can see, mREITs have their complexities, therefore, it is vital to have a smart management team that can navigate the borrowing wisely.

The pitfalls in mREITs do not mean that they should always be avoided. Their high yields and direct payment of profits to investors make them a great source of cash distribution.

Younger, more aggressive investors who do not own any real estate themselves but who are bullish on real estate might want to consider mREITs.

When you build your portfolio, consider the PROs and CONs with mREITs, and allocate the assets properly, so, the percentage they make up is no more than you can afford to take a loss on.

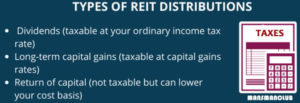

TAX IMPLICATIONS

Folks, the high dividend yields can be attractive, however, the mREIT/REIT dividends should not be taken at face value because you will have to pay a tax. Since those companies must pay at least 90% of their income to shareholders by law, which means that income is not taxed when the company delivers the dividends, however, by April 15th (the last tax collection date in the U.S) the shareholder’s dividends will be instead taxed as ordinary income.

NOTE: If you place the stock in your tax-deferred retirement account, you may avoid taxes.

NOTE: If you place the stock in your tax-deferred retirement account, you may avoid taxes.

The bottom line is that mREIT/REIT dividends are not considered qualified dividends eligible for preferred tax treatment, but are considered ordinary dividends and are taxed at the shareholder’s marginal tax rate. Therefore, the higher your tax bracket rate is, the less you stand to profit. Keep it in mind when you evaluate the stocks.

NOTE: Some REIT dividends can be taxed at different rates because they can be allocated to ordinary income, capital gains, and return of capital. The maximum capital gains tax rate of 20 percent applies generally to the sale of REIT stock.

Before investing, though, look beyond those double-digit dividend yields, no matter how enticing they first appear. By looking at an mREIT’s balance sheet, cash flow statements, and past performance, investors can get a good sense of whether the company is worth investing in, and whether they can stomach the risk.

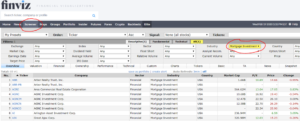

If you want to find all mREITs, go to Finviz.com and use the stock screener (see the picture below with the first several stocks).

(click to zoom)

HOW TO INVEST IN MORTGAGE REITS

mREITs are making up just 6% of the REIT market. Despite falling under the REIT umbrella, mREITs are analyzed separately from equity REITs due to differences in asset bases, business models, and funding profiles.

They are more liquid than physical properties what is allowing mREITs to be more manageable and more flexible. Given this flexibility, many mREITs operate more like a bond fund manager rather than a property owner, actively turning over their portfolio of mortgages and exposures to respond to changing market conditions and expectations. Another feature of mortgages is that they repay their principal (barring a default), while physical properties can have uncapped gains or become worthless.

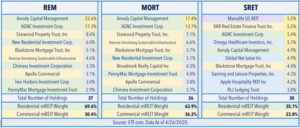

Examples of popular mREITs: AGNC, NLY, NRZ, STWD, TWO, BXMT. If you are looking for ETF that covers mREITs, look no further than REM with 7.87% Yield (at the time of writing) that holds named above stocks in its portfolio.

I don’t hold those common stocks in my portfolio but rather hold their preferred shares from AGNC and NLY that deliver stable income.

While mortgage REITs are certainly not for every investor, I believe that ETFs are a solid option for investors seeking low-cost, liquid, and diversified exposure to the mREIT sector. Several real estate ETFs offer direct or indirect exposure to mREITs including the iShares Mortgage REIT Real Estate and the VanEck Vectors Mortgage REIT Income ETF (MORT) which are pure-plays on the mREIT sector.

The Global X SuperDividend REIT ETF (SRET) is also an option, which tracks an equal-weighted index with exposure to the international real estate operators. (Use any search engine for stock tickers).

I had to add a few words to this article considering the Covid-19 bear market events.

Mortgage REITs have taken center stage over the last two months amid the ongoing coronavirus pandemic due to plunging nearly 70% in March before recovering.

Extreme and unprecedented levels of market volatility and plunge in interest rates triggered a wave of margin calls when investors borrow money to invest and are not able to repay back, so, the brokers sell the underlining assets in a self-reinforcing cycle of "forced selling" which pushed the mREIT sector to the absolute brink.

Meanwhile, recent updates from residential mortgage REITs indicated that the permanent damage to book value (BV) was not as devastating as once feared for the majority of mREITs. While mREITs are not out of the woods yet, I believe that the residential mortgage market remains on a firm footing. Therefore, I did not sell the mREIT stocks but rather added more shares. This move allowed me to decrease the base price of each asset.

You may write your comments below.

If you are not a club member, simply fill out a short form below for free membership. You will get notifications about a new article.

DISCLAIMER: This article is intended to provide information to interested parties. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before following any investment strategies or rules mentioned or recommended. I have used small pieces of information written by other authors. My kudos to them all.

Author's Note: Please excuse any typos. I assure you that I will do my best to correct any errors if they were overlooked.

(click to zoom)

(click to zoom)