My unbiased and comprehensive take on retirement planning. Part II.

8 steps to increase your chances of safer retirement

8 steps to increase your chances of safer retirement

This is Part II of the post. Read Part I if you have missed it.

1) Spend less and save more

You alone are responsible for accumulating enough assets to retire at the time and in the lifestyle of your choosing. Make sure you have a positive cash flow into your retirement saving every year. Track your expenses and create a budget that will allocate 10% - 15% of income to savings and investing. You are lucky if you still have time, perhaps, a few years until retirement.

Your retirement lifestyle will be determined primarily by how much you save and invest during your accumulation years, so, don’t delay and add to your saving today. Ask your company to automatically send a certain percent of your after-tax earnings into a saving account (and not only into 401K).

2) Manage your debt

Consumer and credit card debt is a drag on your financial life. Paying off non-deductible debt is the equivalent of buying a risk-free, tax-free bond that yields the interest rate of the debt.

If you're planning on staying in your current home for the foreseeable future, the best inflation hedge you can buy today is a low-interest 30-year mortgage. You may intend to pay off your mortgage sooner and have no mortgage payments during your retirement years; and this is what AARP suggests, too. Allow me to disagree with such a strategy.

One thing I have learned years ago is how to handle real estate investments. The common (and misguided) concept is to pay off the mortgage as soon as possible. Do you know who really benefits from your extra payments? The big banks.

Open your eyes: you are GIVING YOUR AFTER-TAX CASH to the bank to multiply it by investing. For what? Just to have peace of mind that your house is paid off during retirement?

The result? You are becoming house-rich and cash-poor. Why it’s bad? In the case of any financial turmoil, your neighbor might have the cash to pay for bread but can you pay for bread with your house? You may say it’s an extreme assumption. Is there a guarantee that it won’t happen? Do you know why people are buying physical gold and silver?

The result? You are becoming house-rich and cash-poor. Why it’s bad? In the case of any financial turmoil, your neighbor might have the cash to pay for bread but can you pay for bread with your house? You may say it’s an extreme assumption. Is there a guarantee that it won’t happen? Do you know why people are buying physical gold and silver?

To add to my argument, do you know that while you are paying off a simple interest on your mortgage your neighbor has decided not to pay off the mortgage sooner but rather invest his after-tax money (equal your extra payments) into the market to earn a compounded interest?

Isn’t it better to have more cash and invest it rather give it away to the bank? With your 4% mortgage interest, investing cash into a dividend reinvestment plan with some dividend-generating stocks or funds delivers a better return on investment. Take as an example a giant company AT&T. As of today, they pay a 6.3% yearly dividend.

I can hear the old argument: making a 13th mortgage payment every year can help pay off your home sooner and you pay less interest overall. My answer: if you want your kids to inherit the house it might be a valid reason to pay off the mortgage completely. Otherwise, make regular 12 payments that I consider “the rent payments” (with the benefit of adding money into equity) for the opportunity to live in the house of my choice but use your cash wiser.

Real-world example

Let’s say, you take out a 30-year, $150,000 mortgage at the highest rate you can find today of 5.625%. Making the standard 12 annual payments at $863.48 a month costs you $160,854.46 in interest alone.

But if you make one more payment a year, you can pay off your loan 6 years earlier. Plus, you pay $31,035.44 less in interest.

We are talking about $863.48 per year in extra payments for 24 years. Now, imagine that you have invested in AT&T with an average interest of 6%. If you have bought the shares of AT&T and spent $863.48, with 6% of reinvested dividends, you will have a $3,500 total return for 24 years. I am talking about only $863.48 invested! It corresponds to a 304% return!

Now imagine that you are adding the shares of AT&T for the same $863.48 year after year for 24 years. Next year purchase will generate $3,320 or 282% return; third-year - $3,165 or 260% return, etc. For the life of your mortgage (30 – 6 years=24 years), your investment will generate a total of $48,658 or $17,623 more than saving with the paid-off mortgage! This is a power of compounded interest that the banks will use with your money. Even if the dividend is lower (5%), you still will earn $11,032 more.

I have chosen an extreme interest rate of 5.625% on a mortgage loan but with today’s low-interest loans (~4.5% on average) you can save even more!

Do you follow me? You still will be able to pay your monthly mortgage payments as you are paying now, but instead of adding your 13th payment or sending the lump sum that is highly recommended by the same banks, invest it into AT&T. The reinvested dividends over the years will generate much more cash vs. extra payments to the bank.

I also want to add that YOU will have your cash (cash-rich) and will be paying only the minimum mortgage fee every month, and nothing extra. Don’t worry about the bank – it will strip over $160K of interest anyway, so why make the bank even more cash-rich with your extra payments?

When I understood this concept, I have completely changed my strategy. My current goal is to pay the banks as least as possible. It allowed me to buy more properties with my money, the properties that generated positive cash flow which I have reinvested. This is how you build your wealth wisely.

With any secured debt like your mortgage, car loan, boat, or RV loan the concept is the same. If you can generate a better return with invested cash than you can save by paying your debt off, do it! Pay bare minimum and use your money to your advantage.

3) Fund your 401(k)

The easiest way to save for retirement is a 401(k) tax-free plan. If you're in the 25% marginal tax bracket, a 401(k) contribution yields an instant 33% rate of return. The earlier you start - the better because you'll be maximizing the benefits of compounding growth.

4) Keep Investment Fees and Taxes Down

Don't give your hard-earned money away to brokerages in the form of fees. Small fees add up. The most drastic demo of the fees being added up is the following:

Don't give your hard-earned money away to brokerages in the form of fees. Small fees add up. The most drastic demo of the fees being added up is the following:

Without fees, a $100,000 portfolio earning 10% a year grows to $11.7 million after 50 years. Add in a 1% fee, and your total value melts to just $4.6 million. (Only $794,000 of that difference is actually fees. The rest comes from the lost gains associated with those fees compounded over time.)

Choose your investment wisely. Check the fees especially with mutual funds. The major brokerage firms like Charles Schwab, Vanguard, and Fidelity are fighting for customers by offering the lowest fees. Compare the ETF (exchange-traded funds) fees vs. Mutual Funds. You can find similarly structured investments with lower fees.

Even if the stock trading fees are lower today than they were 5-10 years ago, trade as little as possible.

To reduce my retirement tax bill, I favor Roth IRA accounts and municipal bond ETFs (about 7.5% of my liquid portfolio). Also, I am considering moving to Florida where are no state taxes.

One important thing to remember when you sell your stocks: long- and short-term gains are taxed differently. Save on taxes by selling the stocks held at least for 366 days by shifting to long-term gains.

5) Cut your losses and preserve the principal

I won’t say anything new here but I need to emphasize again that the first rule of any investment is DO NOT LOSE. Follow this rule, and you will have more cash for your retirement.

I highly recommend using trailing stops - the best sell discipline you have at your disposal.

As Investment U noted: “A "trailing stop" follows the price fluctuation of a stock, and adjusts accordingly. We recommend selling shares 25% below their high, or 25% below your entry point - whichever's higher. Here's how it works…

If you bought your stock at $5, your initial trailing stop (sell point) should be set at $3.75 - 25% below your entry point. If it goes to $10, your new trailing stop is $7.50. If it rises to $20 without falling by 25%, then your new trailing stop is $15.

Using trailing stops will ensure the markets, not impatience, dictate your exit points. Plus, it's an automatic way to cut your losses early, and let your winners ride. You will never take an unacceptable loss. And you won't incur excessive trading fees, either.”

I have highlighted this strategy in my 4-parts article, so I won’t explain why the trailing stop should be 25%. It’s up to you what loss you are comfortable with. I just want to mention that when I looked at my losing trades a few years back, I found that if I would not sell the stock when I was scared of bigger losses but let it run, I would be in the profit zone. Sometimes, it makes sense to give the stock enough room to recover.

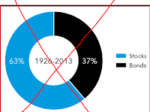

6) Assets allocation – the biggest impact on your portfolio

Whether it's in your 401(k), Roth, traditional IRA, or a taxable brokerage account, you'll want to diversify your holdings by spreading your investments  across different asset classes/categories and not concentrating in one or two.

across different asset classes/categories and not concentrating in one or two.

By investing in a variety of non-correlated assets, you smooth the results. If one asset class is doing poorly, another is likely to do well and can improve your overall return. Please read my 4-parts article that is covering assets allocations in detail.

7) Dividends are your friends

The dividend-paying stocks deliver dividends even if the market is not in the uptrend. I can’t say the same about the growth or value stocks – they all go down if the market is in the downtrend.

Keep in mind that dividend-paying stocks offer attractive attributes for equity investors, including the potential for income what can serve as an additional source of cash for retirees. However, keep in mind that the dividends are not guaranteed. Moreover, dividend-paying stocks represent equity and, therefore, are at the bottom of a firm’s capital structure, below any of a company’s obligations to bondholders.

Persistent dividend growth over many years is a positive reflection on a company’s underlying business and can be an important input in assessing how safe a stock’s dividend is.

By reinvesting your dividends (a free DRIP is preferable), you will use the power of compounding interest. Albert Einstein is also well-known for saying that compound interest is "the most powerful force in the universe."

8) Consider downsizing to decrease your expenses

House equity is the most ignored and misunderstood factor in retirement planning. While it’s one of the largest assets for many people, a lot of money is left on the table. The results of surveys indicate that about 40% of baby boomers plan to move at some point after retiring assuming they will downsize to a smaller home.

By selling your primary residence house you extract the equity accumulated over the years (minus the settlement fees). The equity will help in buying the lower-cost house or condo and, correspondingly, will lower living expenses. It’s a good plan, but many people don’t execute it well.

The biggest problem even is not the money but the family’s well-being. Make sure that you both with your spouse desire to downsize and the downsizing is not the “enforced” decision made by you only.

Make sure you both are comfortable with the idea of living in the smaller space and you are OK with leaving your home where you spent several years together. For some people, the old home is a status symbol, a measure of self-worth and accomplishment, so, a lot of emotions could be involved (including what to take with you and what to throw or give away).

Another factor is how far away your kids and grandchildren will live. It is a separate topic for discussion but I want to emphasize that extensive research and preparation should be done until you both decide to downsize and move to a different area. Man, it’s a lot of work involved!

You know the moot “try before buy”. It could be a great idea to rent for 2-3 months the smaller place in the area where you are planning to move in permanently and see if you like it or need to make some adjustments to your plan.

Please continue to a final Part III of this post.

Like the article? Become a club member for free and get notified about the new posts. 100% spam-free!