My unbiased and comprehensive take on retirement planning

Read an article about retirement, and you will find the same advice: plan your retirement in advance.

Read an article about retirement, and you will find the same advice: plan your retirement in advance.

What kind of plan should it be? It’s not the big plans like for wedding or vacation. It’s more complicated.

In this article, I want to discuss financial planning. And it is not because I am a guru in the financial field – I learn like everyone else – but because I have extracted the most useful information from hundreds of articles, the information that makes sense not in the imaginative world of assumptions (as you can often find in the articles) but in the real world. Also, even I am a newbie among retired folks with only 1 year of experience, I have analyzed hundreds of “advices” – good and bad – and have extracted the most useful.

If you want to understand more about publications for retirees, you have to recognize a single and the most important fact of life: all of the articles and books are written to make money for authors and not for your well-being. I always absorb the information in each of them with a grain of salt.

For instance, a recent article in the AARP about the countdown to retirement had good intentions but not so good recommendations. I want to cut through the confusion and misguided conventional wisdom like the mix of stocks and bonds, for instance.

Ned Notzon and Charles Shriver are portfolio managers in T. Rowe Price’s U.S. Asset Allocation Group are drilling the same hole: “We believe most people would like to have a mix between stocks and bonds. The mix is based on factors such as their age, their tolerance for risk, and their confidence in the economy and the financial markets”.

If you had a chance to read my 4-parts article about investments and assets allocation, you will find that I have some clue about investments. In fact, I have strongly opposed stocks/bonds allocation’s mambo-jumbo.

Since nobody paid me for this writing, below is my unbiased take on retirement planning and various recommendations to those who are close to the retirement age or have already retired and want to correct the mistakes. If you are patient enough and read the entire article (quite sizable), you will find valuable tips that could save you thousands of dollars for your retirement.

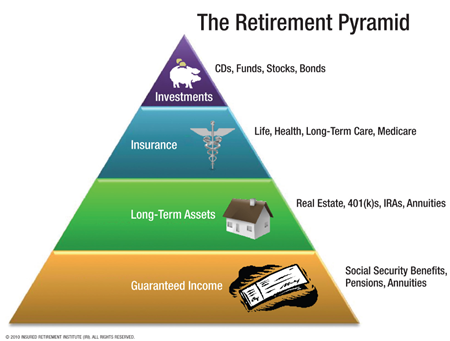

As you see in the retirement pyramid, all retirement financing is all about your assets’ allocation and potential expenses. I have discussed it in A Few Investment Lessons. Part II.

How do you plan it? What should you consider? What are the pros and cons? What would generate enough income? What steps should you take now if you are 1-3-5-7 years away from your retirement?

The retirement pyramid clearly shows the sources of income you should consider. I have mentioned three of four in my article. I have not discussed the expenses like Medicare and Long-term care, yet.

LET’S PUT THE PLAN TOGETHER

LET’S PUT THE PLAN TOGETHER

There is one recommendation that I saw often in the articles for maintaining your standard of living: you'll need to generate 70%-85% of your current income in retirement. As always, this recommendation is based on statistics and the average that may have nothing to do with your personal situation.

First, you need to know what you're up against. Forget about statistics and rather take a look at how much you will be needed every year and how much you've already saved and invested. This will help you determine how much more you might need.

When I began my planning, I have opened the spreadsheet and began filling it out with numbers.

- Yearly Expenses

- Yearly Income (projected)

Be sure to factor in the following:

- Spending habits (track them for 6 months, or 1 year to really know them)

- Yearly Inflation

- Expenses that will be eliminated when you retire, and those that will arise

- Cost of health insurance

I have included the following categories/items in my Excel file:

- REAL ESTATE, LIABILITIES, AND EXPENSES

- Mortgage Loan

- Property Tax

- Property Insurance

- Maintenance (in-house repairs, landscape service, roof, and tree maintenance)

- Management fees

- HOA fee

- Appliances Insurance

- Utilities

- HEALTH INSURANCE & EXPENSES

- Medicare and supplemental insurance

- Health insurance costs for less than 65 years old family members (if any)

- Out-of-pocket expenses (including emergency expenses)

- Dental/vision expenses

- HOME EXPENSES

- Food and Drinks

- Clothes

- Utilities (gas, electricity, water, etc.)

- Cleaning supplies

- House/Apartment Maintenance

- Appliances insurance

- Vitamins/supplements

- Subscriptions

- Dining out/parties

- Jewelry Insurance

- Home Office expenses (software/equipment/supplies)

- Internet/Video/Phone/Home Alarm services

- Personal expenses

- CAR EXPENSES

- Car insurance

- Car loan

- Exhaust Inspection

- Gas, maintenance

- Tag renewal

- TRAVEL EXPENSES

- The total cost of travels

- Travel insurance

- Miscellaneous

- DONATIONS/GIFTS EXPENSES

- Scheduled donations

- 529 Plan for grand-kids

- Other gifts (b-days/holidays)

- MISCELLANEOUS EXPENSES

- Whatever you have (like attorney fee, licenses, etc.)

- Investment fees

- Tax preparation fee

- BUSINESS EXPENSES (if you have any business)

- Licenses and fees

- Salary

- Rent and utilities (if you rent)

- Equipment (incl. maintenance)

- Advertisement

- Subscriptions

- Miscellaneous

- TAXES (expected taxes on your income!)

Look carefully and add what is appropriate for your situation. I have to tell you in advance that to summarize everything is a time-consuming task. You will need to go through your home accounting (I hope you track your expenses somehow like using Excel or Quicken) and even have a conversation with your accountant.

Since you are calculating the expenses for the time when you retire, you may eliminate some of them or, perhaps, reduce them -- like car and gas expenses (are you going to have two cars or one would be enough?). As you will grow older, your expenses will be shifted, for instance, from traveling to supporting your health.

Similarly, you open another workbook in Excel and enter your potential earning and investments. I have the following categories in my Excel workbook:

- REAL ESTATE INCOME

- ANNUITIES INCOME

- SOCIAL SECURITY PAYMENTS

- RETIREMENT ACCOUNTS INCOME (yearly withdrawals)

- IRA

- SEP IRA

- ROTH IRA

- 401K (if any)

- LIQUID INVESTMENTS (potential dividends from stocks, ETFs, CEFs, BDCs, REITs), and HSA (HEALTH SAVING ACCOUNT)

You may want to add:

- NON-LIQUID INVESTMENTS (like precious metals, art, collectibles)

- SALARY (if you plan to continue working full or part-time). Normally, you will need it if your yearly expenses are above your yearly income.

Reduce your income by the amount of expected taxes. Watch for your tax brackets that could be different due to recent changes in the tax code.

As I have mentioned above, don’t forget about inflation. Inflation is our enemy simply because the value of a dollar drops every year. The cost of the products is increasing year after year; the cost of services follows the same route. How to calculate inflation? I will provide some tips at the end of the article.

The revelation time

Your revelation time will arrive when you compare your yearly expenses to your expected income. It will reveal if you can support yourself (including a spouse), and once you know your "Personal ROI," you might have to plan some steps to increase your investments to obtain sustainable returns.

Your goal is to withdraw a certain percent of your income to cover yearly expenses while preserving your principal. There is a constant mulling of the same topic among numerous financial counselors: what percentage of your portfolio can be withdrawn yearly without hurting the principal to support your lifestyle as long as you live?

I have discussed it earlier in the blog but the simple answer is: it depends…

Life span and Inflation

Did you notice, I said, “as long as you live”? Do you know how long? Stupid question, right? And that is one of the variables to consider in your calculations. I saw many tables that reflect the age statistics for men and women but do you want to rely on statistics in your calculations?

I think that the estimate of your life span will rely on the following:

- What was the age of your parents when they passed away (if any)?

- Did they/do they have any serious illnesses like cancer or heart disease?

- What is your current health condition? Do you have any serious issues?

- What is your current lifestyle? Do you exercise a few times a week? Are you sitting home most of the time (beyond work) or prefer an active lifestyle?

My father, for instance, has passed away when he was 93, so I am basing my calculation on the age of 90 and calculate the projections for up to 95 just to get the idea. In your case, it may vary.

The problem with inflation is also the fact that among all of your income producers (unless they are designed specifically to be inflation-protected) the only Social Security payment may be adjusted for inflation, not annuities, not stocks’ returns or dividends, and not retirement accounts. Will it hurt you in the long run? You bet!

The impact of inflation can be devastating. Historically, the rate of increases in wages has exceeded the inflation rate. So, while you are employed, the risk of rising inflation is not so significant. However, once we enter retirement, the risks of inflation increase. One reason is that Social Security benefits are indexed to inflation, not to the cost of living of retirees, which tends to increase faster. For instance, the cost of healthcare has historically risen at a faster rate than overall inflation.

Guys, you need to save more!

DO YOU HAVE TIME TO SAVE MORE?

Truth is the #1 factor determining if you will run out of money while in retirement is how much you saved and continue saving now. If you're not on par with your expected expenses, you could be in trouble.

Saving even an additional $20 a week - quite possible for most men - can deliver you thousands you would have otherwise never seen…

| Number of Years Saving $20 a Week | 5% Average Return | 10% Average Return |

| 10 | $13,700 | $18,200 |

| 20 | $36,100 | $65,500 |

| 30 | $72,600 | $188,200 |

Source: Retirement Confidence Survey, Employee Benefit Research Institute

Please continue with Part II.

Like the article? Become a club member for free and get notified about the new posts. 100% spam-free!