What I’ve learned about the good, the bad, and the ugly Annuities. Part II.

When do you want to buy the annuities?

When do you want to buy the annuities?

As I have mentioned in the first part of this article, annuities make the most sense for pre-retirees and retirees who want to minimize worry about bear markets in retirement: a precise stream of income no matter how markets perform. Annuities, in short, represent certainty in an uncertain world.

Why does it make sense to buy the annuities a few years before retirement? In my case, I’ve also invested in some annuities in 2015 and has retired in 2018. Starting from the next year (in May 2019, after 5 years of waiting period), I will be able to begin my yearly guaranteed withdrawals.

Why did I buy that annuity in the first place? The answer is simple (and this is the only reason why annuities are still worth consideration): I wanted guaranteed income with no headache for the rest of my life. There is another effect of having annuities, more mental than financial: it provides the safety of a guaranteed income (like Social Security, to some degree).

Does it worth paying so much extra to the investment institution to achieve this simple goal? The answer is: it depends.

First of all, it depends on what kind of annuities you are willing to buy. Each of the 5 types (see the table in the first part of the article) has different conditions and different fees.

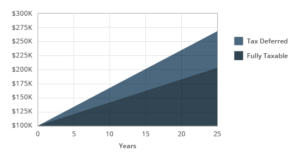

Second of all, it depends on what funds are you going to use: if you are buying with non-qualified funds (regular investment account) or with qualified funds (like IRA/Roth IRA). I used some IRA funds, and later I found that it was another stupid move, since, for instance, the variable annuities in its core are tax-deferred already.

A tax-deferred annuity is a plan in which income tax on an original deposit of investment income is not charged during the investment period. The tax liability is deferred until the owner or beneficiary begins to receive (or accesses funds) periodic payments of earnings from the invested funds.

Click on the chart to zoom. Thirdly, it depends on when you going to retire. As you can see, it makes sense to buy:

Click on the chart to zoom. Thirdly, it depends on when you going to retire. As you can see, it makes sense to buy:

- If you need money right after you have retired and cannot rely on the SSA income only. Buy with keeping in mind a waiting period for starting withdrawals.

- If you can handle your living expenses without those annuities for several years, buy right before your retirement and start withdrawing in a few years.

Factors that affect the size of annuity income: Type of annuity selected, amount of money invested, age, sex (male/female), payment guarantee selected (and whether or not you want the death benefits included).

One important question arises from this discussion: what if you are experienced enough to generate an income with your available cash in the excess of 5-6% per year (no matter of market volatility), does it make any sense to buy annuities? The quick answer is NO. You will save on hefty fees, not to mention applying compounded interest (DRIP), and earn even more.

Some Tips on Buying Annuities

The right kind of annuity can be a functional part of any diversified portfolio just as bonds are.

Consider annuities if you:

- are in a high tax bracket;

- have exhausted other forms of tax-favored retirement savings, like 401(k)s and IRAs;

- want to own more bonds, especially corporate bonds;

- If you are close to retirement or already has retired;

- If you have limited financial management experience and can’t or don’t want to actively manage part of your funds.

If you are 8-15 years from the retirement date but still thinking about guaranteed income with annuities, perhaps make sure you get 5-6% of interest, and some step-ups on the anniversary dates, so your withdrawal rate will increase over time until you begin taking a withdrawal. I would still recommend waiting and instead investing in the indexes.

If you are 8-15 years from the retirement date but still thinking about guaranteed income with annuities, perhaps make sure you get 5-6% of interest, and some step-ups on the anniversary dates, so your withdrawal rate will increase over time until you begin taking a withdrawal. I would still recommend waiting and instead investing in the indexes.

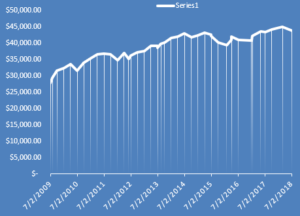

The picture above represents the investment in the MetLife variable annuities with a 6% yearly step-up option. As you see, over time, it has increased in value compared to the previous examples. The initial investment of $27,800 in 2009 has increased by ~57%. At the same time, the fees collected by MetLife were not so pleasant.

Do your intensive research about the fees and find the lowest-fees annuities.

There are 100’s of annuities on the market. They typically offer generous payments in comparison to other investments, such as bonds but many have substantially higher fees, and their payments — reflecting today’s ultra-low interest rates — are not as attractive as they once were. Annuities are likely to become more attractive in the future as interest rates rise, which is widely expected.

Tip: Six questions to ask when buying annuities.

If one of the reasons to invest in annuities is the fact that they are tax-deferred, perhaps don’t be a fool by buying high-fee annuities as they will destroy the benefits from deferring taxes or sidestepping market declines.

Despite the risks, you can do well with a tax-deferred annuity. Follow these eight rules from Forbes. Or skip to the summary down below.

#1. Buy from a no-load fund company. Outfits like Fidelity, T. Rowe Price, and Vanguard don’t have to pay commissions to sellers, so their annual fees are lower and they don’t hit you up for a “surrender charge” if you take your money elsewhere a few years later.

#2. Keep expenses low. Compare the annuity account you like to a low-cost fund that invests in the same sort of securities. Don’t pay more than 0.5% a year extra to get the annuity.

#3. Don’t buy stocks. Put bonds in your annuity. Their high current income makes the deferral feature valuable.

With stocks, you don’t get many deferrals that you couldn’t have had merely by buying an index fund in your taxable account and standing perfectly. Worse, an annuity will convert stock appreciation taxed at favorable capital gain rates into ordinary income taxed at high rates.

If you are tempted to get equity exposure through a deferred annuity, resist. Instead, buy a stock index fund like SPDR (SPY) or the Schwab Total Stock Market Index Fund (SCHB).

#4. Skip the guarantees. Vendors of high-cost annuities create complex products that have you getting protection from market declines in return for giving up some of the gains in up markets. These are always bad deals. Of course, there’s no way for you to know that unless you have two actuaries and a computer programmer working for you.

There’s a better way to protect yourself from the next market crash: Don’t put so much money in stocks. If you can’t sleep at night, switch some of your retirement savings into medium-term bonds.

#5. Put annuities last on your shopping list. First, fill up your 401(k) or a self-employed retirement plan to the max. Next, see what you can do with IRAs, even of the nondeductible variety.

Third, put some money in municipal bonds. Not too much, but some. Tax-exempt bonds are more powerful than annuities at tax time. They give you an exemption rather than a deferral.

Then, and only then, should you think about buying annuities?

#6. Stay put. It takes a while for the cumulative benefit from deferral to overcome the cost drag of a deferred annuity. For a high-bracket investor holding corporate bonds, I figure, it takes more than a decade. And that’s with a low-cost annuity.

#7. Think about liquidity. If you need the money back before you turn 59-1/2, you’ll have that tax penalty: a 10% surcharge, on top of regular income taxes, on any earnings.

A separate liquidity matter has to do with back-end charges levied by the vendor. You avoid this problem by not buying products with these charges.

#8. Use for the intended purpose. The original idea behind deferred annuities was to have your money growing untouched for several years (the “accumulation phase”) and then being converted into a lifetime monthly annuity (“annuitization phase”). It’s not a bad idea.

Suppose you put in $100,000 at age 50, investing the money in junk bonds. It grows to $200,000 when you’re 65. You could just cash in the policy, paying tax on $100,000 of ordinary income. Better: use the $200,000 to buy a so-called immediate annuity paying a fixed monthly sum for as long as you live. A 65-year-old male would get $1,200 a month, or thereabouts, from this lump sum.

The exchange from deferred to immediate continues your tax deferral if you do it right. (It’s called a Section 1035 exchange.) Some of that money you put away when you were 50 is coming out when you’re 80, having benefited from 30 years of tax-deferred compounding.

Remember, though, that an annuity only delays the reckoning with the tax collector. In our example, you’d be collecting $14,400 a year but paying tax on $9,400 because you get a tax deduction of $5,000 a year. Over 20 years you recover your original purchase price with this deduction.

SUMMARY

Folks, please understand that when you put your hard-earned cash into the insurance company, it invests it in the open market. When you are getting your money back, you receive pennies compared to what the insurance company is getting.

In most annuity contracts, you are guaranteed a certain amount of annuity income, and if you choose the right option, it would be an income for the rest of your life. No matter what you choose, you must pay fees and commissions for that guarantee.

Did I mention that any website that sells annuities never highlights the disadvantages?

Do your due diligence (more than usual) to find the benefits of certain annuities that overweight the negatives.

Read more about another aspect of annuities.

Do you have any feedback? Thank you in advance.

DISCLAIMER:

I am not a financial professional, and, therefore, I have expressed my view on the subject based on my own experience and research. Investors are expected to do their due diligence and/or consult with a professional who knows their objectives and constraints. I have used some resources on the Internet, and truly appreciate all authors whose thoughts were included in the article. My apologies if I have mistyped any word (although, I have used the spell checker) or my writing style is not up to your taste (I am not a professional writer, either).

If you like what you read and want to be notified about future articles, please subscribe for FREE (at the bottom of a page)