A Few Investment Lessons. Part II.

A few investment lessons learned by the regular guy. Part II.

Note: Read the first part of this article in the Category: Investments.

Note: Read the first part of this article in the Category: Investments.

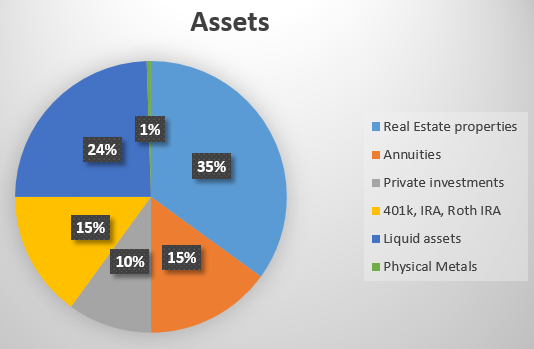

As an active investor, I have separated my assets into a few different investment vehicles:

- Real Estate properties that generate income and allow me to cover the expenses on my primary residence (plus some extras including price appreciation) - 35% of total investment.

- Annuities that I have bought years ago that, that I hope will allow me to have the stream of income upon retirement - 15% of total investment.

- Private investments in the diversified Real Estate companies that quickly raise the cash, do a quick turnover of the assets and sell them while returning investors about 6-8% of the dividends ( with an average holding period of 1 - 5 years) – 10% of total investment.

- 401k, IRA, Roth IRA – 15% of total investment.

- Liquid assets: cash, BDCs and CEFs, ETFs, munis, and stocks - ~24% of total investment.

- Physical Metals (coins) – less than 1% (just as insurance in a case of emergency). There are many suggestions about investing at least 5% in gold, but remember that this investment does not generate profits.

As you see, it has nothing to do with stocks/bonds allocation only. There is nothing certain in this world but even with the possible stock market crashes, I will have to worry mostly about less than 50% of my assets (#4 and #5, and partially #3). With the smart strategy, stop orders, and constant monitoring of the market, I hope to have adequate protection of my assets.

Of those six, #2 and #3 are the investments that are acquired and managed through my Financial Adviser, while the rest are investments that are based on my own research and the lessons I have learned over the years. I will discuss mostly the liquid assets in the second part of this article because they present the biggest challenge in the rapidly changing market environment but first...

…A FEW LESSONS

My poor choices and struggles with investment choices taught me a few valuable lessons:

My poor choices and struggles with investment choices taught me a few valuable lessons:

- Don’t subscribe to the newsletters, no matter how attractive they look and sound – you will lose more than gain. I have lost with most of them in the past. Now, when I am looking at the “best picks” by the newsletter “gurus” and then go to Finviz.com to have a quick look at the stock‘s financials, it makes me sick. They recommend the companies that have terrible volatility, not enough cash to sustain dividend payouts, with recent insiders selling, and the fundamentals that scream: “don’t buy me now”! The purpose of every newsletter or investment service is to make money with the subscription fee but not to make you richer. All of them are proud of their achievements but hide their disasters. Note: Read my article "My Case Against Investment Newsletters".

- Do not trust the new “Nostradamus” who claims to be the best stock picker or who knows in advance about what is going to happen with his stock recommendations. They all sound very convincing but always remember that no one knows the future.

- Do not rely on investment analysts’ opinions when evaluating the stocks (sorry folks!). It hit me just recently when I began using the Finviz.com site for my research (in addition to a few others). When I see the “analysis” by various investment firms and compare it with the stock's movements, it makes me laugh hard! It looks like the firms have hired college graduates to analyze the stocks (for instance, just look at the ETE stock downgrades in February 2016). There are only a few solid investment firms that can predict stock performance with relative accuracy. I am disappointed that some stocks react to those analyses by increased volume and price movements. The investors should completely ignore them and rely rather on the company’s performance but, if you remember, the stock market is a combination of the investors’ moods…

- If you have a financial adviser, you should not trust him 100% even if he is your best buddy. You may feel that he gave you sound investment advice but it always goes with a small attachment for his personal enrichment. I don’t mind if they make a few bucks but are there better investments or fewer fees? Don’t invest 100% of your money with him. This is where you have to diversify, too. With my adviser, I have lost $55K within the first few months. To be fair, he has recovered this amount later with better investment decisions. Since then, I am investing only a part of my assets through my financial adviser, and mostly relying on my own research.

- Be careful with private investments and annuities. Learn to be patient and read the fine script where necessary. Your patience will be rewarded because you may find out the things that will prevent you from losses or, at least will make you aware of any hidden fees. Do not sign any agreement until you have a clear understanding of the investment.

- Learn charting and fundamentals. Do not stop learning. I subscribe to IBD (investors.com) and getting the newspaper delivered weekly that served me well over the last few years. It is where I am getting most of the knowledge about charting, some investment strategies, and the stock market movements. Then more charting indicators you apply then a more precise picture of what is going on with the stock you will get.

- It is easy to buy any stock or fund, the same easy as to lose money on your investment. Find a few useful sites that provide a good set of financial parameters for each investment in addition to good charting. Invest money or time in the good tool (or site) where you can track your investments and do comparison/filtering, or perhaps, learn Excel and monitor your investments and do a comparison of multiple fundamentals before you decide to buy. I use the free Excel spreadsheet (from Excel Scout discussed in the next parts of the article) for live tracking and watch list that I have modified to my taste adding useful functionality. The Excel Scout author is very generous, so my kudos to him. Other writers (even at Seeking Alpha), with all due respect, offer spreadsheets of poorer quality for a fee.

- Collect useful information from various sources. Extract the most useful statements into one or more files that you can read/update at any point. I have the Word file with the menu and several sections like Bonds, Preferred Shares, CEFs, BDCs, REITs, Mutual funds, Metals, Charting Tips, retirement/401K, etc. When you see an attractive stock or ETF, refer to your file – it may help in making a decision (like where I should put my stock: in IRA or taxable account, or which parameters are important when I am considering buying the CEF).

- Learn and choose which investment strategy is suitable to your goals and investment style and experience. Are you a value or contrarian investor? Are you a momentum trader? Do you want to follow the CANSLIM strategy introduced by William J. O'Neil? Do you want to diversify your strategies by combining them? There are many choices and it is not easy to decide but it is what must be done and should be reflected in your investment plan.

- Diversify not only with the stock market. Yes, it requires a different set of skills but you can learn how to invest in real estate, can’t you? If you know how the Fibonacci retracements work, is it so difficult to learn how to buy the right property or how to find good tenants?

- Be cautious. Fellow investors, per my experience, there are more villains in this world than there are decent people. Therefore, my first five rules reflect it. When you read the rosy statements from the company’s CEO, it does not always mean the company is actually doing well because CEO’s bonuses are based on the stock’s performance only.

Please read the third part of this article in the Category: Investments.

Disclaimer: This article is intended to provide information to interested parties. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before following any investment strategies or rules mentioned or recommended.