PREFERRED STOCKS AND SENIOR SECURITIES. PART I.

We have reviewed the definitions of common stock in the previous article. Let’s see what’s the difference between the common and preferred stocks.

We have reviewed the definitions of common stock in the previous article. Let’s see what’s the difference between the common and preferred stocks.

I recommend taking your time to study this guide. I have found that sometimes even experienced investors fail to understand the details of preferred shares. By learning the basics outlined in the guide, you will be prepared to invest in one of the most under-estimated investments.

Preference shares also called preferred shares, are so-named because preferred shareholders have a higher claim on the issuing company's assets than common shares shareholders.

Or to put it differently: Preferred stock refers to a class of ownership that has a higher claim on assets and earnings than the common stock has.

In the unfortunate circumstances for the company (i.e. when the company files for bankruptcy protection and the shares must be redeemed), preferred shareholders must be paid for their interest in the company before common shareholders. They are more “senior” to common shares.

When the company issues the preferred shares, they guarantee dividend payments at a fixed rate, while common shares have no such guarantee but still may offer some dividends. In exchange, preferred shareholders give up the voting rights that benefit common shareholders.

Dividends

Since we did not discuss what the dividend is, here is a short explanation that will help you to understand the advantages of preferred shares.

The companies that have big cash flows and don't need to reinvest their money are the ones that usually pay out dividends to their investors. A dividend is a total income an investor receives from stock or another dividend-yielding asset. The term dividends per share refer to the total dividend a company pays out over 12 months, divided by the total number of outstanding shares. A company uses this calculation to share profits with its shareholders.

I usually prefer when the stock dividends are quoted using the dividend yield. While the dividend rate is expressed as a dollar per share, the dividend yield is presented as a percentage. It is easier to understand and is more meaningful.

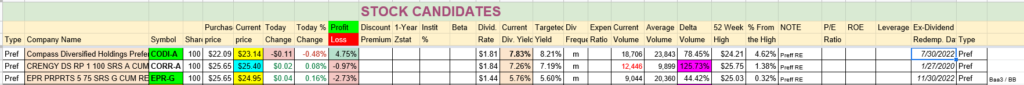

Example: Compass Diversified Holdings company (ticker CODI) offers a $1.44 dividend per share or a 7.83% yield/year. So, if you spent $10,000 to buy CODI, you can expect $783 in dividends at the end of a year. Normally it is paid monthly or quarterly. Many foreign companies pay dividends once or twice a year.

Four Types of Preferred Shares

The preferred shares are a little more complicated than common, and they can be one of four main types:

- callable shares

- convertible shares

- cumulative shares and

- participatory shares

So, let’s have some fun with preferred shares!

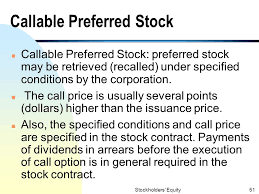

Callable shares are preferred shares that the issuing company can choose to buy back at a fixed price in the future. This condition benefits the issuing company more than the shareholder because it enables the company to put a cap on the value of the stock.

I buy callable shares for income purposes. When I research which one to buy, I want to ensure that two basic conditions exist (not to mention the company’s stability and the stock market condition):

- If the company has the right to buy back its shares, let’s say at $25 (the most common setup), I am trying to buy the stock when its value is below or equal to $25. It is clearly logical, right? Why buy for $26 if in a case the company has decided to redeem the shares at $25 level? I would lose ~4% instantly.

- I always look at the buy-back date. For instance, the Compass Diversified Holdings Preferred Shares Series A (ticker CODI-A) can be redeemed on 7/30/2022, so I have about 3 years to collect the dividends (at this time, it’s 7.8%). It is worth mentioning that the company can decide not to redeem at that date but continue offering the dividends but at a different rate.

If the company retains the right to repurchase callable shares at $25 a share, it may choose to buy out shareholders at this price if the market value of preferred shares exceeds this level. Callable shares ensure the company can limit its maximum liability to preferred shareholders.

The company has also the right to redeem the shares with a callable option in-between (before the maturity date) but at a premium.

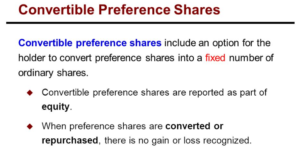

Convertible shares are preferred shares that can be exchanged for common shares at a fixed rate and a certain date. This can be especially lucrative for preferred shareholders if the market value of common shares increases.

Let’s assume you have the convertible preferred shares priced at $100, with a conversion ratio of five. The question is: when it would make sense to convert?

Only if the common stock moves above $20 the conversion would be worthwhile for the investor (5 x $20=$100). Would you convert if the share price of the common stock is $20.5 (5 x $20.5=$102.5)? It is a 2.5% gain, right?

But hey, did you forget about the dividends that the preferred shares offer? If you have a 5-7% almost guaranteed dividend why would you convert to get only 2.5% gain and lose the lucrative dividend?

As the common shares rise, it becomes more attractive to convert. If the common shares move to $25, the preferred shareholder would get $125 ($25 x 5) for each $100 preferred share. That's a gain of 25% if the investor converts and then immediately sells the common stock at $25.

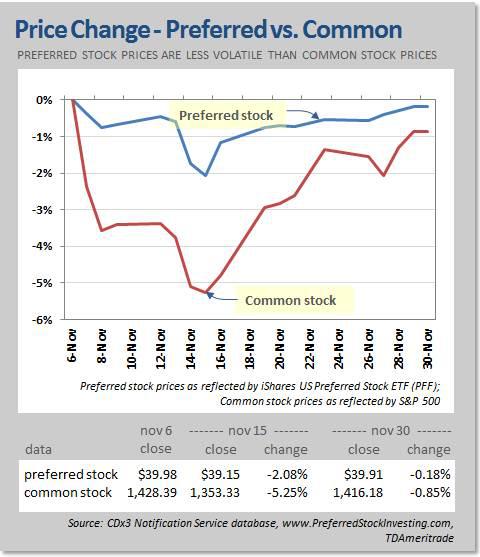

I have emphasized the word immediately because the danger in converting is that the investor instantly becomes a common shareholder. Common shares are much more volatile compared to preferred, and if the price of the common shares will swing in an undesirable direction (for instance, down to $15), and the investor didn't sell at $25, the common shares would be worse less than they were before. You would get $15 x 5=$75 in common shares for each $100 preferred share, not to mention you would no longer receive a fixed dividend.

The conversion back to preferred shares is not allowed.

Preferred shares that include a cumulative part protect the investor against a downturn in company profits. If revenues are down, the issuing company may not be able to afford to pay dividends. In that unfortunate case, cumulative shares require that any unpaid dividends must be paid to preferred shareholders before any dividends can be paid to common shareholders.

For instance, if a company guarantees dividends of $5 per preferred share but cannot afford to pay for two consecutive years, then it must pay a $15 cumulative dividend in the third year before any other dividends can be paid.

Participatory preferred shares provide an additional profit guarantee to shareholders with some conditions: they guarantee additional dividends if the issuing company meets a certain predetermined profit target, and those shareholders who bought participatory shares receive dividend payments above the normal fixed rate.

"Fixed to Floating" Rate Issues

They are issued with a fixed rate that typically lasts 5 years (a few 10 years) and then they go to the floating rate. The rate then typically is 3 months LIBOR plus a stated rate.

"Floating" Rate Preferred Issues

These issues have floating rates from the day they are issued and always contain a floating rate formula with an overriding minimum coupon, usually 3-4.5%. Most of these issues use 3-month LIBOR as part of the equation and add a fixed rate to 3-month LIBOR.

In the last few years, most fixed to floating rate preferred are trading higher after issuance. This is because we are now in an interest tightening phase and income investors are trying to assure their future income stream by capturing potential higher floating rate coupons in the future.

PROs and CONs of Preference Shares for Investors and the Issuing Company

PROs and CONs of Preference Shares for Investors and the Issuing Company

Dividends paid first

Preference shares have a fixed dividend that must be paid before any dividends can be paid to common shareholders.

Higher claim on company assets or low-risk tolerance

In addition, in the event of bankruptcy and liquidation, preferred shareholders have a higher claim on company assets than common shareholders do. This makes preference shares particularly attractive to investors with low-risk tolerance. The company guarantees a dividend each year, but if it fails to turn a profit and must shut down, preference shareholders are compensated for their investments sooner.

Additional investor benefits

Other types of preference shares carry additional benefits (Convertible shares, Participating shares). This variety offers the type of investment that can be a relatively low-risk way to generate long-term income.

There are two advantages for the issuing company:

Lack of shareholder voting rights

It means ownership is not weakened by selling preferred shares the way the common shares are sold by shareholders (including selling short – will be discussed in the next articles). With the lower risk to investors, the cost of raising capital for issuing preferred shares is lower than that of issuing common shares.

Right to repurchase shares

Companies can also issue callable preferred shares with the right to repurchase shares at their discretion. This means that if callable shares are issued with a 6.5% dividend but interest rates fall to 4.5%, the company can purchase any outstanding shares at the market price and then reissue shares with a lower dividend rate what will reduce the cost of capital. Of course, this action will hurt shareholders.

Disadvantages of Preference Shares

Preferred shares also present disadvantages for investors.

Investors can't vote

Preferred shareholders do not have the same ownership rights in the company as common stock shareholders.

With rising interest rates, the preferred shares could be less attractive

When and if interest rates rise, the fixed dividend that used to be so lucrative can quickly look like less of a bargain as other fixed-income investments could be purchased with higher dividends.

Dividends for preferred shareholders do not grow

In bad market conditions, preferred shareholders are covered, but in a bull market, they do not benefit from increased dividends or share price of the common shares (unless you buy convertible shares and convert them to common if the share price is attractive).

Risk Factors of Preference Shares

There is one large segment of preferred shares that I dedicate a large part of my preferred holdings: mortgage REIT preferred.

- Risk Factor - Credit Risk. Credit risk comes from investing in a mortgage REIT that holds a portfolio of very credit-sensitive assets. If a large portion of those assets goes bad, the company could go under. This is a case where losses in their assets could turn into losses for the investor. Do your due diligence in assessing the level of risk here.

- Risk Factor - Default. While the company's default is rarely an issue but is surely the biggest risk factor. Therefore, always keep in mind that there is a bullet-proof company. Just recall Enron. No matter how hard you work on your due diligence, accounting fraud is still difficult to detect without inside information.

- Risk Factor - Spread Risk. Spread risk comes from the risk that a mortgage REIT’s assets and hedges won’t offset effectively and the equity value would be destroyed. When this happens the immediate impact is a large decline in book value per share, so, the common could be wiped out and the preferred could suffer serious losses. I don’t see much risk to the preferred shareholder from this factor. It could happen, but it would be a huge surprise similar to the Default.

- Risk Factor - Yield Movements. This is the risk that while the mREIT (mortgage REIT) remains fine, a substantial move higher in Treasury yields and bond yields leads to a corresponding movement in preferred share yields. In that case, the fair value could decline. Rapid movements in interest rates will often have a temporary negative impact on preferred share prices. If rates go back to moving gradually, the preferred shares usually bounce back.

- Risk Factor - Call Risk. The risk of redeeming shares (calling) is something to consider seriously, especially if you have purchased shares above $25. You can avoid this risk with two types of protection from call risk. One is “calendar protection” when the shares are not eligible for calling yet. The second is “price protection” where you buy the security at a discount to the call value (below $25). That way, if a call happens while you’re still holding the shares it creates a capital gain on the position rather than a loss. Interesting to note, that companies very rarely call securities trading under call value (under $25). Instead, they can simply buy those securities back in the open market. There is no reason for them to issue a call and pay a premium to the market price. Companies usually don’t call their preferred shares unless they are trading at a premium. Normally, they would rather do it when they think they can issue new shares at a lower rate.

How to Research Preference Shares

I normally research preferred stocks using several sources. You can use YahooFinance, Dividend.com, Morningstar.com, QuantumOnline.com, Innovativeincomeinvestor.com, https://www.preferred-stock.com. You may want to use the preferred stocks calculator. You may also find nice discussions on preferred stocks at SeekingAlpha.com website - a great source for information exchange on dividend-producing stocks including Preferred. I extract the data and enter it into my spreadsheet that is automatically updated the quotes online.

The spreadsheet allows me to compare many preferred stocks and monitor the signals (blue - when the stock price is above $25, violet when the volume is above 120%, etc.).

How and when to Buy Preference Shares

Preferred shares can be called by the issuing company at a fixed price (the call price) at any time after call protection ends. Usually, the call price is $25.00. Always look for a redemption date and a current price. Remember that the redemption date is the date when the company has the right to redeem (to call) the preferred shares exactly at the price they were issued (in most of cases, it is $25/share). It means that if you have bought the stock at, let's say, at $25.7 per share and have been holding for several years until the redemption date, you will lose $0.7 per share. It may be not so significant loss because you have collected nice dividends over the years but just keep it in mind.

Because preferred shares have a built-in call value of $25, there is a strong tendency for the stock price to oscillate around $25. It helps to smooth the price deviations that are much smaller than the common stock's price.

As you research the stocks, find the trading range of preferred stocks. The trading range assists investors in knowing the best entry and exit points. Like common stocks, preferred shares rise and fall in price. One goal of diligent research is to find the best entry point. Even if you choose to hold your shares for a long period, you want to purchase them at the lowest price. This is a reason why investors prefer buying these stocks below or at $25/share.

I also look at the 1-year chart to identify the trend and the lowest price. Even if it is higher than $25/share, it makes sense to buy close to the lowest price per year, so, you will have more chances of increased price, in addition to dividends. I know that some investors wait until the price will appreciate and reach a one-year high, so, they sell the shares. For example, the stock has a 5.5% dividend and the price has increased ~6% since the stock was purchased. If all you want is to get a 5.5% return on investment, you have already reached the goal, and you sell the share while looking for another suitable stock to buy. Basically, they are looking to buy at a discount and sell at a premium.

Several rules will help you with your trades on preferred stocks:

- Use the Limit Orders Only. The vast majority of investors, and especially those who have retired and need income, hold the preferred long-term. Therefore, they have poor liquidity. Therefore, it's important to only use the limit orders. Whether buying or selling, you don't want to be the poor sucker that ends up with a transaction 2% to 3% away from the average price.

- Never Use the Stop Loss. Stop-loss orders on non-liquid securities are the worst you can find because you can be coughed by the market maker and will lose your 2-3% on the spot.

- There are two good days to buy preferred stocks. Monday morning and Friday afternoon have historically been the best days to catch the best deviation from the trend.

- Use the limit buy order lower and limit sell higher. A limit buys order at a lower price will potentially let you buy the stock at a discount to a common trend price. The limit order may stay 2-3 months without execution but, as soon as it hits your target price, you will get the stock at a nice discount. The same story is for limit-sell orders at higher prices. If you bought the stock at $24.85 and want to sell when it will hit the premium price, you may place a limit sell order at $26.1 even if the current price is much lower. The benefit is that it may trigger your sell order in the middle of any market session but you don't have to monitor it every day. Unlike common stock, the value of a preferred share can deviate from a much smaller range in many cases.

When you buy below the par (below $25), your final outcome would be a combination of dividend income and capital gain income to produce great returns. Annual dividend rates paid by good Preferred Stocks are between 6% and 9%. Selling downstream for a capital gain pushes your effective annual return the rest of the way – generally well over 10%, Not bad, right?

If you want to purchase Preferred Stocks for their very respectable 6% to 9% annual dividend income and leave it at that, great. Investors buy for less than $25 per share and sell for at least $25 per share so you are positioned to realize a capital gain in addition to the above-average dividend income in the meantime.

Selecting the Highest Quality Preferred Stocks

To qualify as Highest Quality Preferred Stock regular preferred stocks must meet several Selection Criteria. For instance:

1) The issuing company must have a perfect track record of never having suspended dividends on a preferred stock, and

remember most of these are multi-billion dollar decades-old companies;

2) The dividends must be ‘cumulative’ meaning that if the issuing company misses a dividend payment to you they have to make it up to you later (they still owe you the money); and

3) Carry an investment grade Moody’s creditworthiness rating.

So far, I have been successful with these rules. I place my limit-buy orders low and the limit-sell orders high.

Dividend accrual happens during the period from one ex-dividend date to the next, usually every quarter or 4 times a year. If your so-called ex-dividend date is on June 30th, the actual payment date is usually 2 to 4 weeks later. You have to hold shares before pre-market trading begins on the ex-dividend date to get that dividend. Even if you have purchased shares on the ex-dividend date, it won't count toward your dividend, even in pre-market trading.

One more thing you have to know is the stripped price. It is the current price minus the dividend accrual. The simple premise is that you would rather pay $25.00 the day before an ex-dividend of $.50 than pay $24.90 on the ex-dividend date. What is interesting is that the buyer gets the full dividend amount even if he bought the stock the day before the ex-dividend date. Some investors like to "play" with pre-and post-dividend prices but I am not a fan of it.

Therefore, paying $25.00 the day before ex-dividend or paying $24.50 the day after ex-dividend is the same. So, right before the ex-dividend date, I would rather consider buying at a "stripped price" of $24.50 with a regular market price of $25 if it's possible.

I always recommend holding the preferred shares in an IRA, so, the effective tax rate is 0%.

Another tip:

Consider fixed to float preferred shares which makes them more valuable than fixed-rate preferred in a rising interest rate environment. They are very suitable for buy and hold investors. You get a guaranteed (or close to guaranteed - anything can happen in the market) return of your principal even if the interest rates skyrocket. In contrast, the fixed preferred (like NLY-C, etc.) will get killed if interest rates zoom.

When you become more familiar with these values and terms, you will be able to effectively evaluate comparable shares and predict when the risk/reward is separating them from peers. As I mentioned above, I manage the list of at least 30 preferred stocks that I monitor periodically.

Take out note

I am a big fan of the mREIT shares because the preferred shares dividend takes priority over the common dividend. For it to be reduced even a penny, the common dividend must be canceled entirely. In a bankruptcy, the preferred shareholders would expect to get screwed. However, the mortgage REITs holding only agency mortgages are unlikely to ever find themselves in that situation. In an orderly liquidation of assets, those preferred shares should either get their call value or get transferred to a new company buying the mortgage REIT. Either way, they wouldn't be doing too poorly.

For buy-and-hold investors and those who need a regular income rather than growth, the preferred shares are the superior tool. These investors simply need to find the securities that match their needs and an attractive entry point.

So far, I have been very pleased with the preferred stocks. They nicely smooth out the market's ups and downs and guarantee the promised return (just don't forget about mentioned above risk). They deliver the dividends like a clock. I have about 17% of my liquid holdings assigned to the preferred stocks, and I am planning to expand this category of investment.

IMPORTANT NOTE:

For unexplained reasons, the preferred stocks at different sites could have different tickers. For instance, the CODI-A ticker is on Google, CODIPA is on MorningStar.com, CODI_pa on Investing.com, etc. Another variation is CODI.PRA. If you can't find your stock, try using different combinations similar to shown above.

Be aware!

NEXT STEP: SENIOR SECURITY. PART II.

If you like what you are reading, please subscribe below for FREE to get notified about future posts.

Author's Note: I am holding CODI-A, NLY-G, ETP-D, PEI-C, TWO-D, EPR-G, ANH-C, NGHCO, PSB-Y.

I am not an investment professional but I am learning investing for more than 20+ years every day. Please excuse any typos. I assure you that I will do my best to correct any errors if they were overlooked. I don’t have any stocks mentioned here in my portfolio and do not plan to buy them in the next 72 hrs.

Sources: I have no associations with mentioned websites or businesses and did not intend to promote them. I also do not sell investment software but rather share “for free” with fellow investors if I did not pay for any piece of it.

Disclaimer: This article is intended to provide information to interested parties. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to complete their due diligence before following any investment strategies or rules mentioned or recommended.