SENIOR SECURITIES & CORPORATE BONDS. PART II.

This is the second part of the tutorial about more senior securities in the relation to common stocks. Read the first part here.

This is the second part of the tutorial about more senior securities in the relation to common stocks. Read the first part here.

If you are an investor and are interested in investing in a company, buying a company’s stock is one way to invest. Advantages: you can sell out your position at any time for a profit or loss. Also, in addition, you have voting rights and may somehow influence the board of directors’ decisions. However, if the company goes into default, and the stock price tanks overnight, common stockholders are the last on the list to receive any funds that the company has left.

If you want to buy preferred shares, you are losing the growth potential and voting rights (as to me, I don’t consider it a significant disadvantage because I don’t buy large quantities of a single stock’s shares, and won’t make any impact among many larger investors) but getting much more stable stock price - not so volatile. Your return will be in a form of a dividend. Amounts owed to preferred shareholders are paid out before common shareholders.

You can also buy the company’s debt. This included bonds or commercial paper. In exchange for buying these products, you receive interest payments and/or a lump sum back when the paper or bond matures.

What is a Senior Security?

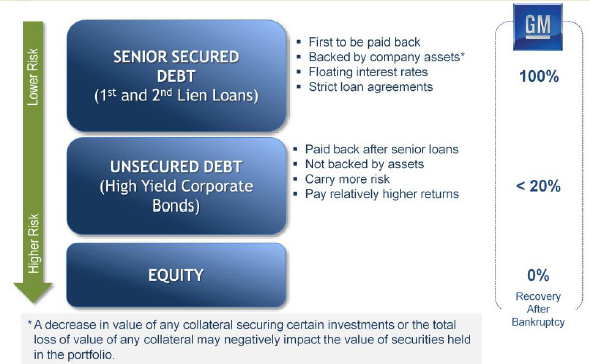

In the event of a company's bankruptcy or liquidation, senior security is one that ranks highest in the order of repayment before other security holders receive a payout. Senior securities are typically considered the safest offering by a company because in the event of default the senior security holders will be paid any funds owed before investors in lower-ranking securities.

How a Senior Security Works

When the company issues any security for trading, each of them has certain seniority or repayment ranking (it refers to the order of repayment back to stockholders or security holders) in the unfortunate case of the company’s default.

Senior Securities are usually issued in the form of a bond.

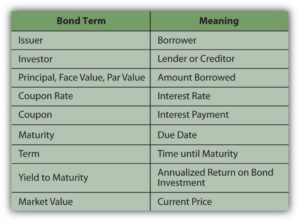

Before proceeding further, let’s see what the word “bond” means. Let’s say, I need money to expand my business. I am issuing the bond for sale to the prospective bondholders. I am getting their money in return, and I am becoming the debt holder, the debt that I owe to my bondholders.

After the sale has occurred, I am obligated to pay the interest (it’s called a “coupon”) at a later date (usually several years) until the bond’s “maturity” date – the day when I have to pay back the principal to each bondholder.

If you have bought the bond, you are collecting the interest every year until the bond is matured. If the company is solid and stable, this is a very good source of income if you found a good balance between the security and coupon rate. Keep in mind that the higher the security of a bond, the lower the interest.

Now, let’s get back to senior securities.

Now, let’s get back to senior securities.

There are several types of bonds. It’s vital to understand the difference because some bonds are safer than others.

The holders of senior secured bond debt have the privilege of getting paid first, before other security holders. Secured Bonds must be backed with collateral, so, if the company has defaulted, the bondholders will get the money back in the form of collateral (whatever it could be).

As you see, this type of bond is very secure, and, therefore, it offers lower interest.

Within this seniority hierarchy, secured bonds must be repaid before other types of bonds debt (subordinated or junior) is repaid. After bondholders are repaid, preferred stockholders have repayment seniority over common stockholders.

Common stock, as we have reviewed earlier, is the least secure in a company's capital structure. It offers the highest potential returns, in the long run, to compensate for an additional degree of risk as the stocks are much more volatile. Common shareholders also have voting rights, while senior security holders do not.

Seniority Ranking

Secured Bonds <-- Senior Bonds <-- Junior Bonds <-- Insured Bonds <-- Convertible Bonds <-- Callable Preferred Shares <-- Convertible Preferred Shares <-- Cumulative Preferred Shares <-- Participatory Preferred Shares <-- Common Shares

Are you confused?

Yeah, the Wall Street folks like the complications. I don’t want to make you even more confused as there are some other variations of debt securities (like hybrid debts). We won’t discuss them, as it is more complicated knowledge that is usually the prerogative of financial advisers and very experienced investors, so, I don’t want to overload you with unnecessary information at this stage.

Let’s make it simpler:

- Bonds in a form of debt rank higher than equity in the payout order.

- Secured bonds rank higher than unsecured ones.

- Senior bonds rank higher than junior or subordinate bonds.

At this point, you have to understand that we are discussing the “corporate” debt bonds and their varieties. Meanwhile, there are also the treasury, sovereign, and municipal bonds! I will cover them later in another article. Just stay with me and subscribe!

Corporate Bonds Types

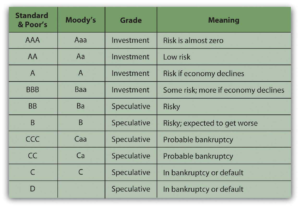

First of all, you should know that corporate bonds are separated not only by type but also by creditworthiness and the term (short-term, intermediate, and long-term). Private independent rating services such as Standard & Poor's, Moody's Investors Service, and Fitch Ratings provide these evaluations of a bond issuer's financial strength and its ability to pay a bond's principal and interest upon maturity.

The level of creditworthiness is defined by the letters in the following order:

Investment Grade Bonds: from AAA down to BBB- or Aaa to Baa3 for Moody’s rating scale.

Aaa/AAA, Aa1/AA+, Aa2/AA, Aa3/AA-, A1/A+, A2/A, A3/A-, Baa1/BBB+, Baa2/BBB and Baa3/BBB-

Investment-grade bonds will usually experience bond yields increase as ratings decrease. The risk is rewarded with a higher yield. Most of the most common "AAA" bond securities are in U.S. Treasury Bonds that are the most secure.

Non-investment grade bonds or “junk bonds: from BB+ down to D or Baa1 to C for Moody’s and could be even “not rated.” Junk Bonds have higher risk and higher yields.

Some speculative bond ratings include:

- CCC—currently vulnerable to nonpayment

- C—highly vulnerable to nonpayment

- D—in default

source: saylordotorg. click to zoom

Because the bonds have different “quality” depending on rating, the bond ratings affect pricing and yield. The rating informs investors about the quality and stability of the bond. It’s up to you, as an investor, to buy bonds of a certain quality in accordance with the risk you are willing to accept.

If you want higher security of your investment, you should choose investment-grade bonds but in return, you will get much lower yields.

When I buy the municipal bond stocks in the form of ETF (exchange-traded fund), I am usually trying to buy above the Ba3/BB- rating as they are more secure. I watch for the same rating if I buy another type of investment: closed-end funds (CEFs) that often consist of equities and bonds in a certain proportion.

I am obviously staying away from B1/B+ junk bonds that indicate that the issuer is quite risky, with a higher than average chance of default unless I buy the junk bonds ETFs for a short-term play.

As you already know, when comparing debt to equity in a case of default, debt always has seniority in the payout order. When comparing unsecured debt to secured debt, secured debt has seniority.

- Secured Corporate Bonds

This is a top-ranking bond. If a bond is classified as a secured bond, the issuer is backing it with collateral. This makes it more secure in the event the company defaults. Examples of this are companies that issue a secured corporate bond by backing it with assets like industrial equipment, a warehouse, or a factory.

- Senior Bonds

This one is the second-highest bond to be paid after secured bonds are paid off. Basically, anything with the title senior attached to it means it ranks higher than junior or subordinated debt

- Senior Unsecured Bonds

As you may guess, while Senior unsecured bonds are still senior, but they are not secured by collateral. They are paid off third in the hierarchy.

- Junior, Subordinated Bonds

After the senior securities are paid out, the junior (or subordinate, status means they only are paid out after senior bonds), unsecured debt will next be paid out from what assets remain. This is unsecured debt, meaning no collateral exists to guarantee at least a portion. Bonds in this category are often referred to as debentures.

- Guaranteed and Insured Bonds

These bonds are more complicated because the third party is involved. The guarantee is not provided by collateral but by the third party in the event of the company’s default. That entity or organization is taking over the debt and will continue paying the interest as obligated.

For instance, an example of this category of bonds is municipal bonds (that I have mentioned above) backed by a government entity or corporate bonds backed by a group entity.

While at the first glance this bond is quite secure, it still provides a lower level of security that is based only on the credit rating from the credit agency as well as a third-party’s own credit rating. Perhaps, they are still “secured” and are much less risky than non-insured bonds. As I found, insured bonds will always have a higher credit rating because there are two companies guaranteeing the bond, but this security comes with a lower yield.

No win situation, right?

- Convertible Bonds

Convertible bonds are issued in an attempt to attract more investors because they offer the option to convert the bond into common stock shares under favorable conditions. No doubt, any advantage will be hit with a lower yield compared to standard bonds, as always, not to mention that in the event of a company’s default, it isn't a useful feature because the market price on the common stock is usually falling down and the bonds will be paid out only after all the more senior securities have been paid first.

What is a Recovery Rate?

Reading through my notes, you may ask “why should I buy the bonds? They are so complicated with all those varieties…"

Don’t be discouraged. If you want to be a successful trader, non-stop education is a must. Get used to it. I guarantee that your trades will be more profitable if every day you’ve learned something new. Here is a small tip regarding bond’s terms and definitions:

source: saylordoorg

Now, let’s see how the companies that issue bonds are rated by the “recovery rate” in a case of bankruptcy.

The recovery rate for a bond refers to the amount of the bond’s total value. This includes both interest payments and the principal that are likely to be recovered in the event the issuer defaults.

This recovery rate is the corporate bond’s payout value in the event of a default. You will find the examples below.

Recovery Rate=Value (under default)/par value of a bond (%)

If you want to estimate the potential risk of a bond, look at its recovery rate.

There is one more very simple indicator for estimating the risk: a loss-given default (LGD) that derives from a recovery rate. Loss-given default (LGD) is the amount of money a bank or other financial institution loses when a borrower defaults on a loan.

So, for example, if an investor was considering a $50,000 bond investment (principal) with a recovery rate of 30%, the LGD would be 70%. This means that in the event of default, the payout would be 30% of the principal, or $15,000. So, the LGD in this example is $35,000.

If let’s say, the bank has issued a mortgage loan on a single house, and the customer did not pay the outstanding debt of $250,000. If money would be lost completely, it would be a 0% recovery rate. However, the bank has issued a foreclosure, repossessed, and re-sold the house for $180,000. The difference between the outstanding debt and the sale price is $70,000.

Recovery Rate=180,000/250,000 or 72%

LGD=250,000-180,000/250,000 (%) or 28%

Or put it even simpler: LGD=100%-recovery rate

With costs relating to the repurchase included, the LGD is 28% (difference between outstanding debt and sale price divided by $250,000).

Based on relevant factors (read below), the recovery rates may vary significantly.

- The higher in seniority ladder bonds are, the higher the recovery rate they offer. In reality, a bond’s recovery rate is directly proportional to its payout seniority in the event the issuer defaults. Per studies by high-ranking economists:

- the secured debt recovery rate was 56%

- the unsecured debt recovery rate was 37%.

- the subordinated debt recovery rate was 31%

- the junior subordinated debt recovery rate was 27%.

- The recovery rate of any security or corporate bond is affected by macroeconomic conditions like the overall default rate, the current stage of the larger economic cycle, and general liquidity conditions. If you remember the financial crisis of 2008 in which many companies (like dot com) were defaulting, the overall default rate negatively impacted a security’s recovery rate.

- Another factor to consider is the company’s overall level of debt among other factors, because the lower a company’s debt-to-asset ratio is, the higher the recovery rate investors can expect.

You can buy the bonds with any large brokerage company as individual bonds (after careful due diligence) or as the ETF/CEF with wider diversification among several bonds as well as even with some leverage that allows offering higher yields (CEFs). I prefer the latter.

No doubt, as an investor (especially close to or in retirement), you are seeking higher yields on your money while wanting to secure your principal. One choice to consider is government bonds but the yield on that bonds is usually pity low. What you may want to consider is to sell low-yielding, high-priced government bonds and buy higher-yielding, lower-priced corporate bonds. that is tied to a company's fundamentals and are less susceptible to the caprices of the Fed. Even BB-rated corporate "junk bonds" have a default rate of only 0.18%, so it's worth reevaluating whether you really need Uncle Sam's guarantee to rest easy.

The Takeout

Any investor in corporate bonds or any other debt instrument should pay significant attention to the security classification of the debt. The different security types are directly linked to the potential recovery rates in the event of a corporation’s default. Furthermore, other factors that affect the recovery rate always should be taken into account.

At this point, I want to finish this article. You may read more about bonds in my NEXT article.

If you like what you are reading, please subscribe for FREE below to get notified about future posts.

Author's Note: I am not an investment professional but I am learning investing for more than 20+ years every day. Please excuse any typos. I assure you that I will do my best to correct any errors if they were overlooked. I don’t have any stocks mentioned here in my portfolio and do not plan to buy them in the next 72 hrs.

Sources: I have no associations with mentioned websites or businesses and did not intend to promote them. I also do not sell investment software but rather share “for free” with fellow investors if I did not pay for any piece of it.

Disclaimer: This article is intended to provide information to interested parties. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before following any investment strategies or rules mentioned or recommended.