What You Need to Know About CEFs (closed-end funds)

My Favorite Investment

Guys, I can bet that the majority of novice investors have not even heard about CEFs. I have been trading on the stock market for more than 10 years but never heard about them, and only when I have discovered the Seeking Alpha web site, I have discovered the power of CEFs.

While I was a strong critic of any investment newsletters, this website (and I don’t promote it!) has very valuable discussions where the comments are sometimes worth more than the publication itself. The site has links to many investment newsletters that you can subscribe to but I skip them and concentrate on comments to free publications.

When I have learned about closed-end funds and their power, it became my favorite type of investment. Why? Read below.

So, what is CEF?

It is easy to give you a few bullet points to explain it quickly:

- It is a mutual fund (but not traditional);

- Like a mutual fund, a CEF has a professional manager supervising the portfolio and actively buying and selling holding assets;

- No new investment capital flows into the fund. The manager does not have the right to increase the number of initially issued shares – there is always a fixed number of shares (unlike the traditional mutual fund),

- After Initial Public Offering (IPO), the investors have the opportunity to buy the fixed number of issued shares. After all of them were sold, the offering is "closed”, and, therefore, it is called “closed-end fund”;

- The manager does not have the right to sell the shares (or buy back);

- CEF is being bought and sold by investors, like common stock shares on the secondary market through any brokerage account.

- It trades like equity or ETF (unlike the traditional mutual fund), as its price fluctuates throughout the trading day;

- Practically every CEF issues the dividends (monthly or quarterly);

- It can use the leverage to increase the yield, and, therefore, is very attractive to income-seeking investors;

- It can be sold at a discount to NAV (net asset value) or premium which can deviate widely. While the mutual fund's share price is based on the net asset value of the portfolio, the stock price of a CEF fluctuates according to supply and demand and underlying values of CEF’s holding.

- The CEFs are run by an investment adviser through a management team that trades the portfolio, and, for this reason, are usually charging hefty annual management fees that can reach as high as 3.0%;

- CEFs normally have a specific goal or style of investing in mind;

- And, finally, it is always an actively managed fund, unlike passively-managed Index funds and most ETFs.

Why Do I Hold CEFs in My Portfolio?

First of all, every CEF holds a number of stocks, bonds, or other investment vehicles. It allows great diversification similar to an open-end mutual fund. I will discuss the subject of diversification in future articles, but for now, try to understand that buying one company from any sector is always much riskier than buying several for the same amount of money. If one company will be distressed for any reason, it will not be reflected in the CEF price so widely as it would be the case when you hold only one company.

For instance, the Liberty All-Star Equity CEF (ticker USA) is holding AMZN, GOOG, ADBE, CRM among others. You have plenty of opportunities to choose the fund that corresponds to your asset allocation and preferences. So, a diversified portfolio is one of the CEFs benefits.

For instance, why would I buy AMZN only with no dividends if I can buy it in the CEF (among other desired blue-chip stocks) and, in addition, to have the sizable dividend? Do you follow me on that?

As I have already mentioned above, another advantage (for instance, over ETFs) is the fact that all CEFs are actively managed by investment professionals who have the knowledge, flexibility to choose the underlying assets, and the power of computing. By the way, lately, more and more managers are using the power of artificial intelligence (AI) in their research. Because CEF does not redeem investor shares, they don't maintain large cash reserve levels leaving them with more funds to invest and more flexibility.

The factor that most attracts me to CEFs is higher yield. Using the power of leverage (borrowing capital), the CEFs offer unparalleled dividends. If you would look into my portfolio, you would find many CEFs with 6-10% dividends. Some of the CEFs are offering monthly distributions but most of them quarterly. By reinvesting sizable dividends you can use the power of compounding that significantly increase the value of your assets over time.

I also use many CEFs with proven track records (currently 31% of my liquid portfolio) to:

- leverage the skills of the portfolio manager (do your due diligence);

- gain income from sectors that typically don't provide them (thanks to CEFs’ dividends);

- gain access to asset types I wouldn't have access to otherwise (like special types of investments, other than stocks/bonds).

The leverage of CEFs can reach as high as 40%+. No doubt, the leverage can play also a negative role, so, now, let’s discuss the cons of closed-end funds.

Take the Risk into Account

As with any investment, you should know what you are dealing with. Due diligence is a must before you are ready to spend your money.

![]() The first risk to discuss is VOLATILITY.

The first risk to discuss is VOLATILITY.

Consider this: due to leverage, the market prices of CEFs can be more volatile as they can go from discount pricing to premium pricing (and vice versa) in a relatively short period. It often happens during market corrections when the market prices can drop much faster than the NAV (the underlying assets).

Closed-End funds can be shorted the same way the stocks are being shorted. It may put additional pressure on the fund.

If you are not comfortable with higher volatility stay away from CEFs or at least avoid the leveraged CEFs (some of them don’t use leverage but offer less attractive dividends). Always look at the volatility per week/month. The percentage above one indicates higher volatility vs. average.

![]() The second risk is PREMIUM over NAV:

The second risk is PREMIUM over NAV:

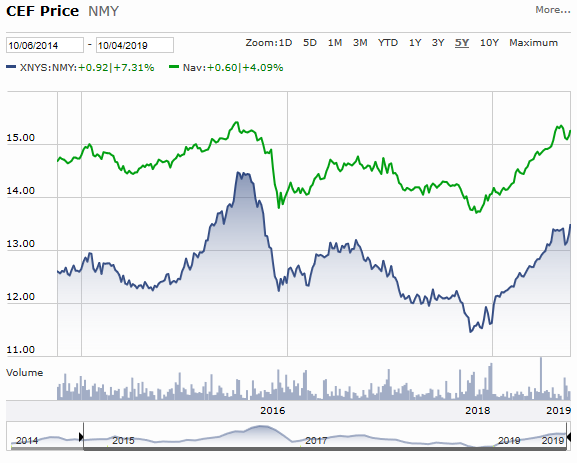

As I have mentioned before, CEFs are unique compared to ETFs in that they can trade at a discount or premium to NAV. I use these metrics to buy the funds that are discounted allowing every dollar invested to buy more than that dollar’s worth of what the fund is invested in. The discount is measured in percentage. You can find discount/premium values at the Morningstar.com website. A premium price means the price of a share is above the NAV, while a discount is the opposite, below NAV value (see the chart below).

Conversely, popular funds will often trade at a premium to NAV where every dollar you invest is backing less than that dollar’s worth of investments. You may ask why would an investment trade at a premium? The fund’s management qualification and past results may create higher demand, and the CEF will be traded at a premium. For instance, Pimco Dynamic Income Fund (PDI) has been trading at a premium for the last 3 years. In fact, as of today, the PDI is traded at a crazy +19.50 % premium to NAV.

Sometimes, the CEFs are invested in assets that are illiquid and hard to value or are trading at a discount themselves. Consider Oxford Lane Capital (OXLC) or Eagle Point Credit (ECC) yielding 17.46% and 14.06%, respectively. They have been trading at a premium for more than 2.5 years (+20.18 % and +34.24 % premium respectively); meanwhile, Nuveen MD Quality Muni (NMY) has been trading at a discount (currently at -11.59 %) for more than 5 years.

The bottom line: I stay away from paying any significant premiums over the NAV prices (even if the stock’s chart is very attractive) unless there are some very compelling reasons. However, limiting your investments to only those trading at a discount would cause you to miss many opportunities. Sometimes, I buy the CEF with a low premium if it is being traded similarly for a prolonged amount of time and all other valuations are satisfying.

![]() The third risk is LOWER LIQUIDITY

The third risk is LOWER LIQUIDITY

If you compare the number of shares traded for CEFs vs. open-ended funds, you will find that the CEFs are traded with fewer shares. Lower liquidity usually results in wider ask/buy offering. With low liquidity, it is harder to sell your CEF.

Source: Morningstar.com

![]() The fourth risk is LEVERAGE AND HIGH FEES

The fourth risk is LEVERAGE AND HIGH FEES

The leverage can be hugely beneficial in good times but can be damaging during tough times when the market is in correction or bear condition. The leverage also causes higher fees because of the interest expense on borrowed money in addition to the baseline expense. If a fund is using significant leverage, you want to make sure that the leverage is used effectively by the management team.

When you do your due diligence, the best way to know this is to look at the long-term returns on the NAV that is calculated taking into account all expenses and after paying the dividend distributions. So, if a CEF is paying high distributions and growing (or, perhaps, maintaining) its NAV over time, it should serve well its investors.

![]() And, finally, the fifth risk is ASSET-SPECIFIC (or CONCENTRATION) RISK

And, finally, the fifth risk is ASSET-SPECIFIC (or CONCENTRATION) RISK

I have been surprised to find out that many funds hold similar underlying assets. If you do not investigate the holdings of each CEF before investing, you may end up buying the same stock or the same asset in different CEFs, and, as a result, over-investing into one single asset. For instance, all of these CEFs are holding Microsoft (MSFT) as the biggest percentage: EOI, ETV, EXD, ETY.

You still can mitigate the problem by diversifying into different types of CEFs ranging from equity, equity covered calls, preferred stocks, mortgage bonds, government and corporate bonds, energy MLPs, utilities, and municipal income.

Specific CEFs that invest in foreign markets have the corresponding foreign market risks, including currency, political and economic risk as well as additional fees on profit (ex: Canada -15%).

Some Examples of CEFs

Types of CEFs: REITs, BDCs, Utilities, Finance, Bonds, Municipal Bonds, Commodities, Preferred, Metals.

See https://www.cefa.com/FundSelector/Classifications.fs.

The largest of CEFs considering the assets under management are municipal bond funds. These large funds invest in debt obligations of state and local governments and government agencies. For instance, I favor the municipal fund that is located in my State. It can give me the advantage of a tax-free investment.

Managers of large funds often seek broad diversification to minimize risk, but also often rely on leverage to maximize returns.

Many managers also build global and international funds with stocks or fixed-income instruments worldwide. These include global funds, which combine U.S. and international securities; international funds, which purchase only non-U.S. securities, and emerging markets funds, which can be highly volatile and less liquid due to the countries where they invest. I prefer funds with a good level of diversification into various assets to minimize the risk.

One of the largest CEFs is the Eaton Vance Tax-Managed Global Diversified Equity Income Fund (EXG) with a market cap of US$2.8 billion as of October 6, 2019. The primary investment objective is to provide current income and gains, with a secondary objective of capital appreciation.

CEFs Resources

https://innovativeincomeinvestor.com/cef/

https://cefadvisors.com/investRes.html

https://cefadvisors.com/investRes.html

https://www.blackrock.com/us/individual/education/closed-end-funds

https://www.nuveen.com/closed-end-funds/resources

Sources: I have no associations with mentioned websites or businesses and did not intend to promote them.

Disclosure: Please excuse any typos. I assure you that I will do my best to correct any errors if they were overlooked.

Additional disclosure: Disclaimer: The information presented in this article is for informational purposes only and in no way should be construed as financial advice or recommendation to buy or sell any CEF. Please always do further research and do your own due diligence before making any investments. Every effort has been made to present the data/information accurately; however, the author does not claim 100% accuracy.

If you liked what you see on this site, subscribe for free to get notified about the next article. You can find the form below.