Mutual Funds – the oldest investment vehicle beyond stocks

A mutual fund is an investment company that absorbs investors' money to invest in securities. An open-end mutual fund continuously issues new shares when investors want to invest in the fund by sending money directly to the fund, and it redeems shares when investors want to sell. A mutual fund trades directly with its shareholders, and the share price of the fund represents the average market value of the securities that the fund holds.

For decades, investors have turned to traditional actively managed, open-ended mutual funds for an easy-to-use product to help them meet their financial goals and deliver the potential to outperform a benchmark (often a widely followed index).

Mutual fund investing does not prevent investing in other securities on your own. In my portfolio, I use a combination of mutual funds along with common and preferred stocks, CEFs, BDCs, MLSs, ETFs, and REITs. The mutual funds would ensure your participation in overall market moves and add to the diversification of your portfolio, while the individual securities would provide you with the opportunity to apply your specific investment analysis skills.

Keep in mind that mutual funds are NOT traded like other assets. You cannot sell the mutual fund on the same day. It usually occurs the next morning at the market price. Why not? Because mutual funds are usually long-term investments, so, there is no reason to trade them daily. Even more, some of the funds have restrictions where you can’t sell within 30 days or will pay a penalty.

Every mutual fund manager wants you to hold your investment as long as possible. They will send you a warning message if you attempt trading the fund instead of investing.

Now, let’s learn what are specific terms related to mutual funds only.

- Fund Load

- A load is a sales commission that goes to the seller of the fund shares;

Loads reduce the total amount being invested: $10,000 invested in a 5% front-end load fund results in a $500 sales charge and only a $9,500 investment in the fund;

Let’s say, you want to buy a mutual fund with a so-called front load. A Front Load is being charged upfront. So, if you buy a mutual fund with a front load, your initial investment will be immediately reduced by the front load fee. As I see it, a load does not go to anyone responsible for managing the fund's assets and does not serve as an incentive for the fund manager to perform better because the funds with loads, on average, consistently underperform no-load funds when the load is taken into consideration in performance calculations. You are not only losing a certain % from your investment but only any possible earning on that amount in the future.

- Keep in mind that for every high-performing load fund, there exists a similar no-load or low-load fund that can be purchased more cheaply;

The bottom line in any investment is how it performs for you, the investor, and that performance includes consideration of all loads, fees, and expenses. There may be some load funds that will do better even if you factor in the load, but you have no way of finding that fund in advance. The only guide you have is historical performance, which is not necessarily an indication of future performance. With a heavily loaded fund, you are starting your investment with a significant loss—the load. Avoid unnecessary charges whenever possible.

- Other Fees

It is best to stick with no-load or low-load funds, but they are becoming more difficult to distinguish from heavily loaded funds. The use of high front-end loads has declined, and funds are now turning to other kinds of charges. Some mutual funds sold by brokerage firms, for example, have lowered their front-end loads, and others have introduced back-end loads (deferred sales charges), which are sales commissions paid when exiting the fund. In both instances, the load is often accompanied by annual charges.

On the other hand, some no-load funds have found that to compete, they must market themselves much more aggressively. To do so, they have introduced charges of their own.

The result has been the introduction of low loads, redemption fees, and annual charges. Low loads—up to 3%—are sometimes added instead of the annual charges. In addition, some funds have instituted a charge for investing or withdrawing money.

Redemption fees work like back-end loads: You pay a percentage of the value of your fund when you sell the fund. Loads are on the amount you have invested, while redemption fees are calculated against the value of your fund assets. Some funds have sliding scale redemption fees so that the longer you remain invested, the lower the charge when you leave. Some funds use redemption fees to discourage short-term trading, a policy that is designed to protect longer-term investors. These funds usually have redemption fees that disappear after six months.

Some funds, usually index funds, may charge a fee, of 1% for example, on all new money invested in the fund. This charge covers the cost of investing the new money.

Annual fee. It is obvious that you have to do the funds comparison to find similar funds with similar holding but with a less annual fee. The lowest cost funds are from Vanguard and Schwab.

Probably the most confusing charge is the annual charge, the 12b-1 plan. The adoption of a 12b-1 plan by a fund permits the adviser to use fund assets to pay for distribution costs, including advertising, distribution of fund literature such as prospectuses and annual reports, and sales commissions paid to brokers. Some funds use 12b-1 plans as masked load charges: They levy very high rates on the fund and use the money to pay brokers to sell the fund. Since the charge is annual and based on the value of the investment, this can result in a total cost to a long-term investor that exceeds a high up-front sales load. A fee table is required in all fund prospectuses to clarify the impact of a 12b-1 plan and other charges.

The fee table makes the comparison of total expenses among funds easier. Selecting a fund based solely on expenses, including loads and charges, will not give you optimal results, but avoiding funds with high expenses and unnecessary charges is important for long-term performance.

All possible Non-Load Fees

- Redemption Fee: This is a fee charged when shares are redeemed, similar to a back-end load. Unlike deferred sales charges, however, redemption fees are paid directly to the fund, not the broker. The SEC limits redemption fees to 2%.

- Exchange Fee: A fee charged if a shareholder transfers assets to another fund within the same group of mutual funds.

- Account Fee: This fee is separate from any investments, and is instead charged for maintaining an account with a certain firm. Some may charge, for example, for accounts that have below a certain amount of funding.

- Purchase Fee: Similar to a front-end sales load, purchase fees are paid upfront when making an investment, but they instead go to the fund rather than a broker.

- Management Fees: These are paid each year to the fund’s investment advisor from the fund’s assets to compensate for managing the fund’s portfolio.

- Distribution/12b-1 Fees: Also paid out of the fund’s assets, these fees cover distribution expenses and shareholder service expenses. The “12b-1” term comes from an SEC rule of the same title that allows for these fees to be paid.

- Pros and Cons

There are several advantages that mutual funds offer individual investors.

- Professional investment management is usually at a low cost, even for small accounts;

- A diversified group of securities that only a large portfolio can provide;

- Information through prospectuses and annual reports that eases comparisons among funds;

- Special services such as check writing, dividend reinvestment plans, and periodic withdrawal and investment plans;

- Account statements that make it easy to track the value of your investment and that ease the paperwork at tax time.

Mutual funds, because of their size and the laws governing their operation, provide investors with diversification that might be difficult for an individual to duplicate. This is true not only for common stock funds but also for bond funds, municipal bond funds, international bonds, and stock funds—in fact, for almost all mutual funds. Even the sector funds that invest only within one industry offer diversification within that industry. The degree of diversification will vary among funds, but most will provide investors with some amount of diversification.

On the other hand, there are some notes to consider:

- With mutual funds, you lose the flexibility to quickly buy or especially quickly sell the asset.

- Most mutual funds can be replicated with ETFs that will allow you to buy/sell on the same day if needed.

- If you have 401K (or similar) plans from your employer, the plans are limited to a small number of mutual funds only where you can place your money. Unfortunately, you are losing flexibility with this type of investment. And, unless you changed your job and are free to move your 401K funds elsewhere (but not take the distributions), you are out of luck.

- Do your due diligence before investing

Investment gurus suggest investors consider the following factors when evaluating a mutual fund.

- Fund Objective: Understand a fund’s investment objective and approach.

- Role in Portfolio: Ensure that you know the role a fund plays within your overall portfolio.

- Diversification: Determine whether a fund helps to diversify your overall portfolio or provides more concentrated exposure to certain sectors or attributes.

- Risk-Adjusted Performance: Look for favorable long-term risk-adjusted performance.

- Performance in Up and Down Markets: Evaluate relative performance in up markets and down markets.

- Style Consistency: Check whether a fund maintains a consistent style with its investment objective and across time.

- Expenses: Seek competitive fund expenses.

- Portfolio Turnover: Assess whether portfolio turnover is consistent with the investment strategy and appropriate for your tax situation.

- Manager Tenure: Look for consistency in portfolio management.

- Fund Company Values: Research the fund company, not just the fund.

- When comparing the performance of two or more funds, always start by matching those in similar categories. The return patterns of different categories may not be comparable, especially over longer periods. The correlations between stock, bond, real estate, and commodity funds all decrease over time. Even within broad asset classes, there can be differences. A large-growth fund may experience different returns than an equity energy fund or a small-value fund.

- Once comparable funds are identified, look at performance over a variety of periods. First, examine the year-by-year returns for each of the past five years. Ask if one fund has consistently been better than the other. Has either fund been volatile with big gains and big losses? Has either fund had a single year with a large gain or a loss that could skew its annualized returns?

- Look at annualized returns for the past three-, five- and 10-year periods. Determine which funds have higher returns and better grades. If one fund’s annualized returns are better, go back and look at its past volatility. Is the better return attributable to consistency or just one or two big years?

- Then look at the category risk index This reflects how volatile a fund’s returns have been relative to its peers. A better grade implies less comparative volatility in returns. A worse grade implies more volatility. A fund with better returns but a worse category risk index will have realized its performance advantage by experiencing more volatility. Its performance advantage should exceed its higher level of risk. If it doesn’t, shareholders aren’t being adequately compensated for a higher level of risk.

- A simple way to determine this is to compare each fund’s category risk index to its three-year returns. If the more volatile fund’s category risk index is, say, 20%, higher than the less volatile fund’s category risk index, its three-year annualized returns should be at least 20% higher.

- And, finally, consider the risk:

- Over long periods of time, stocks outperform bonds. The outperformance of stocks is, in part, compensation for their higher level of risk. Stock prices are more volatile than bond prices. The higher volatility leads to bigger gains during favorable market conditions and bigger losses during down markets. This is why mutual stock funds have larger total risk ratios than mutual bond funds do.

- Risk also exists on the income side. Bond funds realize higher yields by taking on more risk. They can do so by holding fixed-income assets with higher levels of sensitivity to interest rate changes and/or issued by entities with a higher chance of default (credit risk). Both can result in more volatile returns and higher risk ratios.

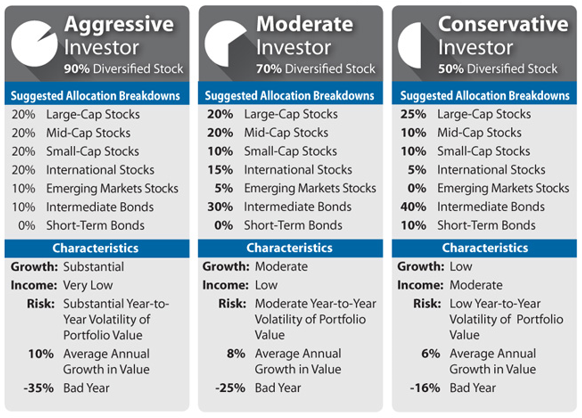

For the mutual funds only portfolio, you may consider the following allocations:

- What should you buy: mutual funds or ETFs?

Today’s investors face what seems like an ever-growing variety of investment choices, with new mutual funds and exchange-traded funds (ETFs) continuing to arrive. In recent years, actively managed, fixed income exchange-traded funds have appeared, combining the ETF structure with the potential to outperform an S&P 500 index.

As you consider ETFs and open-ended mutual funds, it is important to recognize how the vehicles’ features can influence your experience. Buying and selling, pricing, disclosure, costs, holding period return, and tax implications can all be different (see the table below). For example, unlike with a traditional open-ended mutual fund, shareholder demand can influence an ETF’s market price, which can result in the shares trading at a premium or a discount to the ETF’s actual net asset value (NAV). The flexibility offered by ETFs—continuous pricing and the ability to place limited orders—means the return measurement is largely based on the market price return during the holding period rather than on the ETF's NAV.

| Characteristics for Actively and Passively Managed Funds | ||

| Exchange-Traded Funds | Open-ended Mutual Funds | |

| Buying and Selling |

|

|

| Pricing |

|

|

| Disclosure |

|

|

| Costs† |

|

|

| Holding Period Return |

|

|

| Tax Implications |

|

|

| * ETFs and mutual funds are subject to management fees and other expenses. | ||

While mutual funds and ETFs are different, both can offer exposure to a diversified basket of securities and can be good vehicles to help meet investor objectives. What is important is for investors to pick the best choice for their specific investing needs, whether an ETF, an open-ended mutual fund, or a combination of both.

Here are some points to consider when weighing vehicle options:

- Is the ability to execute fund trades at prevailing prices throughout the trading day important? Consider ETFs.

- Is there a preference for trading a fund at NAV without paying a load and avoiding the potential of paying a premium at purchase (discount at the sale)? Consider no-load mutual funds.

- Is the flexibility of trading on margin important? Consider ETFs.

- Does dollar cost averaging part of an investment strategy? Consider mutual funds.

- Is it important to know a fund’s holdings each day? Consider ETFs.

- Make sure to consider the expenses related to any investment vehicle.

- Do the benefits of both ETFs and mutual funds have the potential to help meet investment goals? Consider building a portfolio incorporating both types of vehicles to gain exposure to different asset classes.

USEFUL LINKS ABOUT MUTUAL FUNDS

https://wealthyretirement.com/mutual-fund-calculator/

https://wealthyretirement.com/compound-interest-calculator/

https://wealthyretirement.com/retirement-readiness-calculator/

https://wealthyretirement.com/stock-position-size-calculator/

https://wealthyretirement.com/dividend-reinvestment-calculator/

I hope it is enough learning material to have some knowledge. Open the brokerage account and enter any ticker for a mutual fund, and you will be presented with a lot of data. Best of luck!

Disclaimer: The information presented in this article is for informational purposes only and in no way should be construed as financial advice or recommendation to buy or sell any mutual fund. Please always do further research and do your own due diligence before making any investments. Every effort has been made to present the data/information accurately; however, the author does not claim 100% accuracy. I have used some materials in this article from my old notes. My kudos to authors.

If you liked what you see on this site, subscribe for free to get notified about the next article. You can find the form below.

Club Admin