Investor Educations: REITs

REAL ESTATE INVESTMENT TRUSTS (REITs)

Real estate is great. And it’s definitely a great way to make your money work for you. Read my posts about real estate here:

https://mansmanclub.com/how-i-became-a-real-estate-investor/

https://mansmanclub.com/real-estate-investing-how-to-buy-and-rent-landlord-101/

https://mansmanclub.com/mortgage-pay-off-debate/

But the deals can get complicated… there the banks are involved… financing… you have to go look at the property… deal with tenants and clogged toilets.

Well, the main trouble with real estate (beyond all others) is its "illiquidity", and liquidity is the key for everybody who is just starting out. That means if you made a mistake with the stock or fund, you can get out quickly because they are liquid (can be sold immediately or the next day).

The trouble with real estate, if you made a mistake buying the wrong property, you are on your own because you cannot quickly cut your losses. That's why I don't recommend investing in real estate if you do not have enough experience in handling the business, choosing the right property in the right location, and handling the stress associated with the property’s problems and your potential tenants. Read my articles mentioned above to see my point.

Don’t get me wrong, I love real estate, but I spent a lot of time studying it because you make one mistake, you're the captain of the Titanic on your purchase. So, if you made a mistake with non-liquid investment, like real estate, you can’t cut your losses immediately.

This is where you want to look for alternatives. What if you buy the part of the real estate business that is run by experienced management who will take all the troubles in their hands? If you become the shareholder of such a company, no banks, tenants, maintenance, collecting rents, etc. will be involved for you as an investor.

Here we come to REITs.

If you have a chance to read about CEFs and ETFs, not to mention common and preferred stocks, in my previous articles, you know that some of those investments could be quite complicated. With REITs, expect more nuances and complexity.

You may ask why to bother? Because of great benefits including excellent dividends! Because you can diversify your portfolio with real estate assets that historically outperform the market.

Let’s start from the beginning.

In accordance with Investopedia, a real estate investment trust (REIT) is a company owning and typically operating real estate which generates income. Properties included in a REIT portfolio may include apartment complexes, data centers, health care facilities, hotels, infrastructure—in the form of fiber cables, cell towers, and energy pipelines—office buildings, retail centers, self-storage, timberland, warehouses, etc. (see the picture). It is not enough to know that you want to buy REIT. You have to choose one or more sub-industries (see the picture below). Each of them has its own specific.

With REIT, you can buy the shares of a company, ETF, or CEF, and rip the benefits of dividend-based income, diversification, and long-term capital appreciation.

With REIT, you can buy the shares of a company, ETF, or CEF, and rip the benefits of dividend-based income, diversification, and long-term capital appreciation.

You will need to choose not only the company but the variation of REITs (malls, industrial, healthcare, etc.). This nuance requires more research on your part as each of them has its own specific.

For instance, you know the impact of Amazon on retail sales. Many businesses are going bankrupt (recently, Pier One). Maces have closed 20 locations just last month. The same is going on with many other retail businesses because people are buying more online.

The result is that the malls are under serious pressure because the businesses do not rent the real estate space at the malls as much as it was before Amazon's dominance. So, I am staying away from investing in the mall REITs.

If you are in the business of leasing the space and collecting the rent payments, you are NOT the REIT company, yet, (but a single landlord) unless you comply with certain provisions in the U.S. Internal Revenue Code as follows:

- Invest at least 75% of its total assets in real estate, cash, or U.S. Treasuries

- Receive at least 75% of its gross income from real property rents, interest on mortgages financing the real property, or from sales of real estate

- Return a minimum of 90% percent of its taxable income in the form of shareholder dividends each year (excellent, isn’t it?)

- Have a minimum of 100 shareholders after its first year of existence

- Have no more than 50% of its shares held by five or fewer individuals during the last half of the taxable year

- The REIT should be an entity that is taxable as a corporation (not LLC) in the eyes of the IRS (or other international entity if you shopping for foreign REITs).

- The REIT must have the management of a board of directors or trustees.

As for the U.S., an estimated 87 million households have investments in REITs, either directly or through mutual funds and ETFs. In fact, I have 23% of my liquid portfolio invested in REITs.

There are three types of publicly-traded REITs (regulated by the U.S. Securities and Exchange Commission (SEC):

- Equity -- that own and operate income-producing real estate (REITs)

- Mortgage -- that provide mortgages on real property (mREITs)

- Hybrid -- that own properties and make mortgages

Let me start with equity REITs, and then, I will publish the article about mREITs because it’s a lot to cover.

HOW TO CHOOSE THE RIGHT REIT FOR YOUR PORTFOLIO

HOW TO CHOOSE THE RIGHT REIT FOR YOUR PORTFOLIO

If you want to invest in REITs, just use your local broker and buy the share in the open market, the same way as you buy any other shares of a non-REIT company. You can also buy the mutual fund, CEF, or ETF that have diversification as they include many companies in certain proportions and market cap weight.

I recommend you carefully evaluate each investment to ensure you are buying the company or fund that satisfies your personal requirement.

As for the real estate trusts, start with the management team and track record to find out how they are compensated. Hopefully, they have performance-based compensation that would indicate that they would work hard and smart.

Don’t be intimidated by the valuation measures described below. Do it once-twice, and you will be familiar with the entire valuation process. You might be lucky if you will find the articles about the current valuation of your particular REIT (Look at SeekingAlpha website, for instance), so, you will save time, but I still recommend you to do it on your own – the best way to learn.

There are several metrics of the equity REITs that should be taken into account when comparing similar investments in the real estate trusts:

- EPS

- Dividend Yield

- FFO

- FFOPS (the industry standard for determining earnings growth of a REIT)

- CFO

- AFFO (a more accurate measure of residual cash flow and earnings potential than the traditional FFOPS)

- CAD (for dividend distribution)

- CapEx

- And don’t forget to look at the chart!

As always, look for future growth in earnings per share (EPS) estimate and current dividend yield. Many experienced investors prefer to judge the company in this field not by EPS primarily but by the REIT’s funds from operations (FFO) that define the cash flow generated by the REIT's assets.

To calculate FFO, look at the income statement (can be found on the company’s website or SEC site) and add depreciation and amortization to earnings and then subtract any gains on sales. All REITs must disclose those numbers by law.

FFO = Net Income + Depreciation + Amortization - Gains on Sales of Property

You can also use FFO-per-share (FFOPS) ratio when evaluating REITs and other similar investment trusts. Just take the result from the formula above and divide it by the number of outstanding shares (total amount of shares in the open market).

Please don’t confuse FFO with a REIT's cash flow from operations (CFO), which is reported on the firm's statement of cash flows, and instead reports the amount of money a company brings in from its ongoing business activities. FFO should not be considered as an alternative to cash flow as a measure of liquidity.

While FFO is a good measure of cash flow, some investors prefer a more precise estimate of REIT’s earning potential through adjusted funds from operations (AFFO).

AFFO=FFO – Any Recurring Expenditure

These recurring capital expenditures may include such maintenance expenses as painting projects, and/or roof or windows replacements. AFFO is considered a more accurate estimate of a REIT's earnings potential.

If you are a dividend hunter, you would also look at Cash available for distribution (CAD) - a REIT’s cash-on-hand that is available to be distributed as shareholder dividends.

CAD=FFO – Recurring Capital Expenditures (CapEx)

CapEx is the funds used by a company to acquire, upgrade, and maintain physical assets such as property, buildings, an industrial plant, technology, or equipment. If you have access to a company's cash flow statement, no calculation is needed. Look for the company's CapEx in the Cash Flows from Investing section of the company's cash flow statement.

Please don’t confuse long-term expenditures (like new projects for CapEx) with short-term operating expenses.

Another valuation commonly used with REITs is the Financial Management Rate of Return (FMRR).

At this point, it’s more than enough for novice investors. If you won’t be intimidated by those calculations (and, I guess, they are very simple, right?), you may pick up several REITs and choose which one is suitable for your portfolio or go with ETF/CEF for diversification (read below for explanation).

Again, why would you invest in REITs? Let’s consider the benefits vs. disadvantages.

Pros and Cons of Investing in REITs

Pros and Cons of Investing in REITs

Dividends received from REIT holdings are taxed as regular income.

Pros

- Liquidity (traded as any stock in the open market)

- Diversification/Counterweight to other assets

- Much better transparency about taxes, finances, and ownership (because regulated by SEC) than with private real estate properties

- Stable cash flow in the form of dividends

- Risk-adjusted returns

- Professional Management

- Minor tax advantages. (Some REITs can deliver not only dividends but the return on capital that will lower your cost basis)

Cons

- Low growth/Little capital appreciation/growth due to only 10% of income could be reinvested back to enterprise (90% should be distributed as dividends)

- Mostly, non-tax-advantaged

- Subject to real estate market fluctuations

- High management fees

As I have noted above, in order for companies to apply for REIT status, they must distribute 90% of their taxable income in the form of dividends. Therefore, the control over the cash flow is given to the investors who are legally entitled to receive large dividend payments. It makes them ideal investments for retirees.

With my approach, I like the REITs for their dividends, while I recognize disadvantages. It doesn’t mean I invest in each particular stock for the long term without monitoring it. When the time arrives, I may take the profit quickly and sell it knowing that I can replace the stock with another attractive REIT.

Another tactic to investing in REIT is buying the preferred stock of a single REIT instead of common shares. It does not offer growth but the dividends are scheduled to be delivered every quarter with added stability. And you know the advantages of the preferred stocks, right?

For this reason, I rarely buy a single company’s common shares because I need more income than growth (if you remember, I have retired). Examples: MNR-C, CMO-E, ARR-C.

If you want the REIT stocks on steroids and get even higher dividends, buy the CEFs that invest in REITs. Due to the leverage used with CEFs (what is considered a more risky investment), the dividends can reach 8-10%. Examples: IGR, NRO (in my portfolio at this time), and RIF.

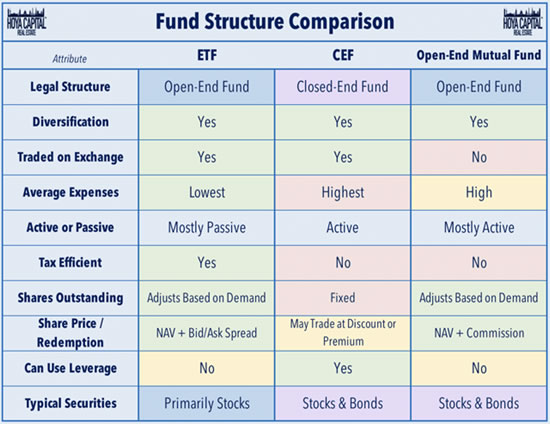

Real Estate CEFs typically hold a wider range of securities than ETFs including preferreds, bonds, and other investment vehicles. For comparison of ETF, CEF, and mutual funds, please look at the following table from Hoya Capital:

Real Estate CEFs can make sense for certain investors seeking high income, active management, and are willing to pay a higher expense premium for it (the expenses are already factored into the stated distribution/yield).

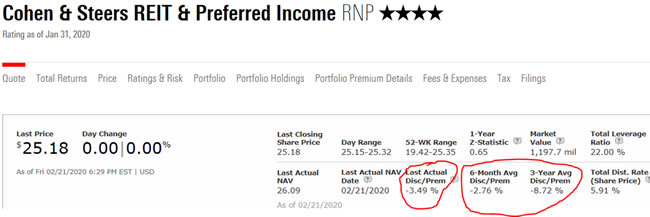

I am usually buying the CEFs at a discount to NAV (net asset value). To verify if the current price is discounted, I use the Morningstar.com website (see the snap picture).

When you make a decision, don’t forget to compare the current discount with an average discount for the last two quarters and/or 3-year, as well as look at the stock chart. It is wise to buy the CEF with a discount higher than average.

You may write your comments below.

If you are not a club member, simply fill out a short form below for a free membership. You will get notified about a new article.

DISCLAIMER: This article is intended to provide information to interested parties. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before following any investment strategies or rules mentioned or recommended. I have used small pieces of information written by other authors. My kudos to them all.

Author's Note: Please excuse any typos. I assure you that I will do my best to correct any errors if they were overlooked.