Investor Education: DIVIDENDS

As I have promised, below is another article for those readers who are interested in becoming financially independent by learning the basics of investing.

As I have promised, below is another article for those readers who are interested in becoming financially independent by learning the basics of investing.

If you have missed previous posts, here are the links:

- Introduction to Investing

- How to Start Stock Trading

- Common Stocks

- Preferred Stocks (Part I)

- Preferred Stocks (Part II)

- ETFs: Exchange Traded Funds

- CEFs: Closed-End Funds

To find more posts, browse the entire category.

What Is a Dividend?

One of the best and most proven ways to accumulate wealth is to buy dividend-paying stocks and reinvest the dividends.

Every quarter (or every month), your dividends are buying more shares and adding to the total number of purchased shares on which your next dividend payment is calculated. Even better, investing in dividend-paying stocks that consistently raise dividends puts this compounding effect on steroids.

Over the years, as my investment skills were improving, I have discovered the power of dividends for myself. The closer I was to retirement, the more dividend-generating stocks and funds I was buying. It paid off very well.

Let’s say, your stock has performed well during a year by gaining a modest 8%. In addition, the stock has paid a 5.5% dividend. So, your total is a 13.5% gain! It is up to you what to do with the dividend but I would prefer to reinvest the 5.5% cash by buying more shares of the same stock, so, the next year I may expect more cash for the same 5.5% dividend.

It is quite a simple operation if the company supports DRIP (dividend reinvestment plan). The good news is that most brokerage firms (like Fidelity, eTrade, or Schwab) allow you to do it with a single click of a mouse.

Now, let’s go into more details.

Companies that have advanced from the growth stage may choose to pay dividends to their shareholders. A dividend is a cash distribution of a company's earnings to its shareholders, normally declared by the company's board of directors. It can be paid out in cash or shares to stockholders on a dollar-per-share basis or they may be quoted in terms of a percentage of the stock's current market price per share, which is known as the dividend yield. The dividend rate is expressed as a dollar figure, the dividend yield is presented as a percentage.

Let's assume that a company's stock pays an annual dividend of $2.0 per share. If the company pays the dividends quarterly, for each payment, an investor receives a dividend of $0.5. The dividend rates are $0.5 per quarter or $2.0 annually. Quarterly dividends are the most common for U.S.-based dividend-paying companies. However, some companies will distribute dividends monthly (I love them!) or even annually, semiannually like many foreign stocks.

The dividend yield represents the ratio of a company's current annual dividend compared to its current share price.

Dividend Yield = Annual Dividends per Share / Price per Share

And here we have an interesting effect: while the dividend (in $$) remains the same if the share price drops, the dividend yield (in %) rises. The yield will fall if the stock price rises. It's simple math. Please memorize this fact, as I will discuss it further.

A Note: You should recognize the difference between a Current Yield (%) that is based on a current stock price and announced dividend vs. a trailing 12 Month Yield (%) -- the percentage income your portfolio returned over the past 12 months. The dividend yield for the underlying stocks and funds is calculated by dividing the total dollar amount the security paid out as income for 12 months to shareholders by the share price (source: Morning Star).

Trailing 12 months (TTM) is a term used to describe the past 12 consecutive months of a company’s performance data, that’s used for reporting financial figures.

Why would the companies distribute their cash to shareholders?

There are several situations:

- To offer extra benefit for investors/shareholders but to lure them into buying the stock and attracting more money into the company’s budget.

- The obligation to pay dividends because of the way the company is structured by law.

- When the company’s executives don't know (or are cautious to) how to grow the company anymore, they start paying a dividend.

- The company’s willingness and ability to pay steady dividends over time provides a solid demonstration of financial strength.

Dividends are usually paid out of earnings as a reflection of the company’s strength, although some companies borrow funds to cover their dividend payouts if the cash flow is dropping -- a bad sign.

HOW TO CHOOSE THE RIGHT DIVIDEND STOCKS

I love the dividends. You can design the calendar (in Excel or Word for Windows) where you may indicate when the next dividend is expected. It is like a job compensation check that comes twice a month. The difference is the predictability of future payment and, of course, the schedule.

While you have a stable job, the checks are guaranteed. So, there is quite a high level of certainty about the future. I can’t say the same about dividend stocks, bonds, ETFs, or CEFs because if you choose the wrong one, you may regret your decision.

When you look for dividend investing, you should consider a firm’s growth trends, financial strength/quality, leverage (if any), and valuation. Successful dividend-paying stocks must possess good business models, strong balance sheets, growth in sales and earnings, positive free cash flow, attractive valuations, as well as a history of rising dividend payments. When you capture all of them in an investment, you are on your way to increasing your overall returns, and, of course, future monthly or quarterly payments.

Why this is important? Assume that the company struggles and must borrow cash from the bank to cover the dividend payments. For some time, the shareholders are happy. However, by borrowing the cash from the bank, the firm is taking the obligation to repay it back plus interest. And, if the problem with getting income is not solved by the management, the firm will be forced to pay the bank first, and only then to the shareholders.

The only way to solve the problem would be to cut the dividend.

For shareholders, that’s a double whammy. Not only are the fixed payments lowered, but the share price generally falls, too, which means the value of the investment has headed south. Cutting the dividend clearly indicates that the firm is struggling with its business. So, what would you do in this case? You would cut your losses and sell the shares. It is what most of the investors would do, and this drives the price of shares down (more sellers than buyers).

How would you predict that the company will have the problem?

One way is to look at the cash flow statements on the company’s quarterly reports. If it appears more cash is being paid out in dividends than the company is generating, the company may consider cutting or even canceling the dividend altogether.

There is also a good indicator that many investors use:

Dividend Payout Ratio

The dividend payout ratio may be calculated as annual dividends per share (DPS) divided by earnings per share (EPS) or total dividends divided by net income.

- Dividend Payout Ratio= Annual Dividends per Share / Earnings per Share

The payout ratio is the percentage of annual earnings paid out in dividends.

For example, if a company has $100 million in earnings and pays out $50 million in dividends, the payout ratio is 50%. It pays out 50% of its earnings in dividends. Try to calculate yourself using both formulas.

- Dividend Payout Ratio = Dividends paid / Net income

The dividend payout ratio may also be interpreted as the percentage of net income that is being paid out in the form of cash dividends.

Generally, a company that pays out less than 50% of its earnings in the form of dividends is considered stable, and the company has the potential to raise its earnings over the long term. I consider the payout ratio 75% or below as a safe investment.

If to use Finviz.com (a very good site for quick stock analysis), you may find the Payout Ratio (ttm) (Trailing 12 Months) for AT&T on the snapshot below. As you see, it is higher than 75%, and this is the main concern for the company’s shareholders that attracts a lot of debates. I have shares of this company as one of my core holding, mostly for their 5%+ dividend. While they are debating, so far, I am collecting the dividends every 3 months and reinvesting them into more shares while accepting the risk associated with it. Your exposure to the risk could be different.

If a company pays out greater than 75% of its earnings it may not raise its dividends as much as a company with a lower dividend payout ratio. Additionally, companies with high dividend payout ratios may have trouble maintaining their dividends over the long term.

In some cases, the payout ratio is often more than 100-200% like with REITs and mREITs, and their debts are correspondingly higher. While it is kind of scary, I always look at the amount of cash the company has in its pockets, the past history, and…

In some cases, the payout ratio is often more than 100-200% like with REITs and mREITs, and their debts are correspondingly higher. While it is kind of scary, I always look at the amount of cash the company has in its pockets, the past history, and…

One note: When evaluating a company's dividend payout ratio, you should only compare a company's dividend payout ratio with its industry average or similar companies.

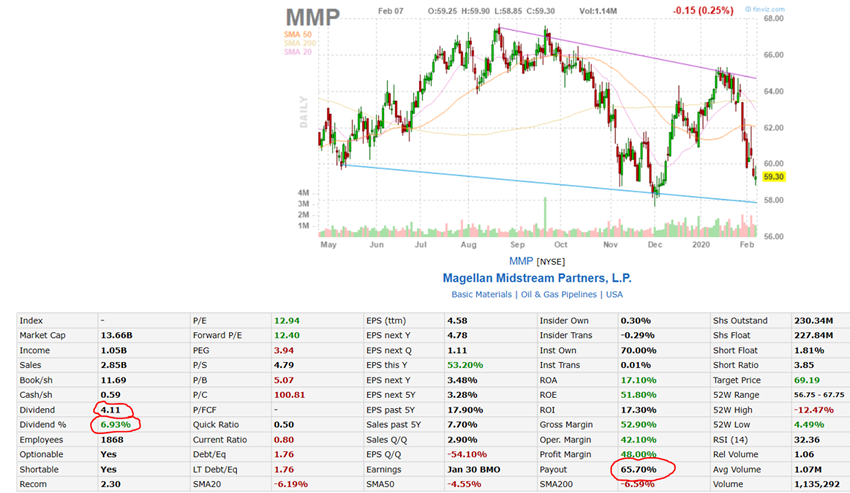

Look at the picture below. It is a snapshot from the Finviz.com site for the dividend-producing stock with a dividend of $4.11 per year or a 6.93% yield. With a payout ratio of 65.7% is safe to assume that the company has enough free cash flow to expand and support the business (even though, the chart does not look promising).

Benjamin Graham explains his approach to dividend investing as follows:

“Paying out a dividend does not guarantee great results. But it does improve the return of the typical stock by yanking at least some cash out of the manager's hands before they can squander it or squirrel it away.”

When an inexperienced investor sees the stocks with high dividends (like above 10%), it seemed like a jackpot, however, a high dividend yield can be deceiving. The yield may only be so high because the stock price has fallen, reflecting fundamental problems at the company. Open the 3-year chart to see the big picture.

Choosing a stock starts with a thorough analysis of the individual company, its industry, and the outside environment. But, aside from consideration made when considering any stock (like earning prospect, balance sheet, management, etc.), there are some general considerations to make when analyzing a company’s dividend.

The financial analysis is similar to calculating your own “free cash” per year by analyzing your yearly income: after-tax net earning minus all expenses like insurances, mortgage loan payments, car loan payments, utilities, food, and supplies, etc. Whatever is left can be used for various purposes (like vacations, self-education, or Christmas presents). It is your free cash flow.

Since this post is not about thorough financial analysis but about the dividends, I will mention just a few important parameters to pay attention to.

Strong sales growth is meaningless if management allows costs and expenses to grow disproportionately. I have seen the stocks with a gross margin above 50% but they have so many expenses that the net margin is so thin that I wonder what the management does… It is so inefficient! Therefore, it is useful to analyze the profitability of a company by calculating and tracking various profit margin ratios—gross margin, operating margin, and profit margin. Profit (or Net) margin is the “bottom line” profit that is generated from all phases of the business, including interest and taxes.

Profit margins are expressed as percentage ratios to facilitate the comparison of a wide range of companies that vary in size. It is important to note that margins can differ from industry to industry, so it is vital to compare firms in similar lines of business. Profit margins provide a great window into company and industry trends, the competitive environment, and management’s ability to manage costs.

- Consistent earnings growth

It all starts with earning. A company needs to have a reliable source from which to pay dividends. Companies that have shown a record of consistent earnings growth over many years will often have a business structure that is able to support consistent and growing dividends.

If to look at Apple, as an example, the company’s annual EPS (Earning per Share) growth past 5 years is 13%, and quarterly earnings growth year over year is 19.3%. As you see, it has had consistent growth over the last several years (see the picture below).

- A record of increasing dividends

A company that has a long track record of raising dividends year over year shows that its management is willing to support not only the earnings growth but a serious commitment to the dividend. So, evaluate past history of raising (or cutting?) the dividends.

- A reasonable payout ratio

We have already discussed payout ratios; however, you also have to be aware that while they are useful in determining the dividend coverage “at a glance”, they also are relative. Certain industries, such as utilities, and telecommunications, tend to pay out a higher percentage of earnings in dividends while other industries typically pay out a lower percentage.

As I have mentioned above, a payout ratio should be measured against the industry average, its historic average, perhaps, for the last 10 years, and whether it has been rising or falling. You can use the Finviz.com stocks screener to identify the companies in the same industry.

Plenty of well-known and respected companies pay out dividends. A smaller amount regularly and consistently raised their dividends over time. Example: AT&T, Johnson, and Johnson. Among investors, they are called Dividend Aristocrats.

In general, the investors are looking for growing wealth and maximizing total return. However, there is a growing number of investors like baby boomers who are more concerning about getting the regular income (without losing their shirts) rather than growth.

Dividend stocks could be an answer to their needs. Now, let’s refresh and summarize WHY you want to have the dividend stocks in your portfolio.

BENEFITS OF DIVIDENDS:

When it comes to smart investing, the ability to be defensive when the market is in a downturn can ease you through turbulent times much better than most ordinary investors.

You can be defensive if your portfolio includes some strong, dividend-paying companies. I rarely go to full cash in my account as a "last resort" because the market is down.

There are several defensive strategies that can be played (like 2x-3x bear stocks that I will cover later, or some bonds, preferred stocks, etc.). However, the dividends tend to rise, while the stock’s price goes down. Remember the formulas that I have mentioned above?

Yes, you may see the stock prices that are sliding down, but if you have the patience in addition to strong dividend-paying companies in your portfolio with a good history of paying dividends, you will still get the dividend payments (that are higher because the price of the stock is lower). It works well in the long run. Eventually, the market will recover as well as the price of your dividend stocks.

It's comforting to know that you still have a source of income throughout the mad market. You're essentially being paid for your patience, rather than selling the stocks off like everyone else. Let's take a look at some of the other benefits of dividend-paying assets.

The benefits of owning a dividend-paying company are numerous. Here are three that we feel are most important:

Lower Your Average Cost: When you're receiving a regular dividend payment, and reinvesting those shares, over time it reduces the price you originally paid. When I buy the dividend stock for $50 a share, after getting the dividends, I could see the original price of my stock is $49.75. Next time, it is $49.21, etc. The average cost is dropping while the number of shares is increasing if I reinvest the proceeds. Nice, isn’t it?

It's like buying a house, then renting it out to offset the mortgage payment and property tax and pick up income, while the underlying asset appreciates at the same time.

Stability During Bear Market: As I have mentioned above, when the stock market is under pressure and share prices are falling, stocks that pay dividends are often considered one of the "safer haven" investments, since investors are still receiving income.

Get Management Work for You: When a company is regularly distributing money back to its shareholders in the form of dividends, it requires management's discipline and smart long-term planning to keep that outflow consistent. Knowing that dividend payments must be met reduces the chances that they'll squander your money away. If they pay out too much (remember the payout coverage?), or invest in risky projects, they risk impacting their ability to pay a dividend.

Dividend Reductions or Cancelling: If a company reduces or suspends its dividend payments, it's usually done as a last resort. Management recognizes that changing dividends results in an immediate negative reaction from shareholders. It could signal that the company is having trouble raising cash, or that the business is making less money.

Consider Tax Implications: It’s not the secret that our Uncle Sam (IRS, in this case) wants to take its piece of the pie - and when it comes to dividends, it's a double-whammy. First, it collects the regular corporation taxes from the company. Then, when the company passes what's left down to its shareholders, those investors are then taxed on what they receive.

Non-qualified dividends are the ones that will be taxed as an ordinary income, while the dividends that are derived from the stocks in your IRA, 401(K), or Roth IRA are not taxed.

Your state or your country may have different tax rules and regulations, however, always be aware of taxes. If the dividend is too low (below 3.0%, for instance), the net profit will be reduced by taxes and inflation, which makes it unattractive.

My goal is to have the average dividend yield across the entire portfolio 6%. Combined with some growth (yes, most of the dividend stocks can grow), the net result could be above 10% profit.

Watch for Leverage and Debt: Some of the companies (and many Closed-End Funds) use the leverage to boost their dividends. It is an additional risk that should be considered by investors. You must know what you are buying and be comfortable with the level of debt and amount of borrowed money to use the leverage. The average leverage level in CEFs is around 25-35%. This is a reason why the CEFs pay significantly higher dividends (7-10%) as they can use borrowed funds to cover higher dividends. Know your risk tolerance before adding CEFs to your portfolio.

Growth Ability Under Fire: I have discussed above why the companies are willing to pay the dividend rather than doing something different like investing money into expanding the business or even repurchasing its own share back and increasing the price of its stock.

Examples of the known stocks that are NOT willing to pay dividends: Alphabet (GOOG), Facebook (FB), Amazon (AMZN), Biogen (BIIB), Tesla (TSLA).

If you read a lot about investing (and I highly recommend it), you may find the arguments against the companies that pay dividends rather than investing in the new projects. As always, it is up to the management. Generally, larger companies return part of their profits in dividends when their growth slows.

To be honest, I don’t care “why”. I just buy a great stock, ETF, or CEF, and collect my dividends. No doubt, dividend-paying companies need to be thoroughly researched, like any investment. But adding them to your portfolio and allowing the compounding interest to work to your advantage, could be the answer to defending your portfolio.

One tip: be aware that at the ex-dividend date, the stock price will go down.

For example, suppose the stock has a 5% annual dividend and pays quarterly. On the ex-dividend date, the stock declares a 1.25% dividend, which is usually payable at a future date, like 20-30 days later. On the ex-dividend date, the stock price is automatically marked down by the amount of the dividend, so the stock price goes down 1.25% (because the value of the stock drops the same 1.25%).

At the date of the ex-dividend declaration, your position is down 1.25% on a cash basis, since the stock price went down, but you have not collected the dividend, yet. After 20-30 days of waiting, the dividend will be added to your portfolio (as cash or more reinvested shares). So, now you hope that the stock price recovers to near the precondition (what initially happens under normal market conditions – but not a bear market).

When I pick high dividend stocks, I am not wasting my time with low-yielding stocks. I follow those stocks and watch how they were doing prior to and today. I watch the price movement starting within a month of the ex-dividend date by just looking at a chart.

If the yield is really nice and if the price drops, usually around one week prior to the ex-dividend date or two days prior, I am buying more. If after I bought and the price goes up to the point where I have a profit close to or equal to the expected yearly dividend, I establish the stop-loss trade to lock the profit.

After all, when I have chosen the stock with a dividend, I am expecting my dividend delivered and not even expecting the growth of a value. If the increased value is equal (or more) to the expected profit, why not take the profit, right?

I can either wait for a dip and buy again or go to another stock.

Rule of 72

In the end, I want you to become familiar with something that is called “Rule of 72”. It is used to determine how many years it would take an investment to double in value, with compounding interest. You simply divide 72 by the interest rate, or the dividend yield, or rate of return to determine how long it will take.

For example, if you’re receiving 6% in dividends, divide 72 by 6, and you get 12, meaning the investment will take 12 years to double, all other things being constant. Of course, with stocks, the price is rarely constant, so price appreciation will speed up the doubling process.

Contrary-wise, you’d expect price depreciation to always slow down this process, but when a company’s stock price declines while maintaining its dividend payout, you’ll actually receive more shares when you reinvest your dividends at this lower stock price.

For example, let’s assume you own 100 shares of XYZ company. If it pays out a steady $1.00/share dividend, this is worth 5 shares when XYZ’s price is $20.00 (100 shares x $1.00 dividend = $100.00, divided by $20.00 = 5 shares).

If XYZ’s share price falls to $10.00, and they maintain the $1.00 dividend payout, this reinvested dividend now buys you 10 shares (100 shares x $1.00 dividend = $100.00, divided by $10.00 = 10 shares).

This faster accumulation takes some of the pain out of price declines, but it really comes into play when the stock’s price recovers and goes higher since now you own a greater number of shares.

Logically, the higher your dividend rate is, the faster the Rule of 72 can work to your advantage. However, always look at the dividend payout ratio, which, if very high, could warn you that the dividend may not be sustainable for the company, as we’ve seen in the 2008-2009 bear market.

The “Rule of 72” is why young investors have such a great advantage when it comes to generating wealth since they have time on their side.

CONCLUSION

I have covered a lot but you have to understand that this post will give you the basic knowledge about dividends but there are many intricacies with dividends for each category you will touch. For instance, preferred stocks where you are hunting for a stable dividend, REITs (real estate investment trust that I will cover next time), bonds with dividends, etc.

If you like what you read and want to be notified about future articles, please subscribe for FREE (at the bottom of a page).

Sources: I have no associations with mentioned websites or businesses and did not intend to promote them. I have used a few sources of information, so, my kudos to the authors.

Disclaimer: This article is intended to provide information to interested parties. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before following any investment strategies or rules mentioned or recommended. Please excuse any typos. I assure you that I will do my best to correct any errors if they were overlooked.